Robert F. Engle III

Biographical

“Wake up, Robin”, a gentle hand shook my shoulder. “Let’s go.” It was so very early but I loved those mornings when my father would wake me and take me on an adventure. When I was a boy and we were camping, we would leave in the quiet morning hours to enjoy the lake together, and attempt to catch some fish. He was an experienced fisherman and a kindly teacher. While he was in graduate school at Cornell and the nation was still in the aftermath of the Great Depression, he traded fish and hunted meat for room and board. I did love those mornings and their crisp dawns.

My mother says that my father truly enjoyed having a son. My two years younger twin sisters felt that he didn’t quite know how to enjoy them. But, I wasn’t aware of those things then. So many of my childhood memories involve him. All the excursions into science were shaped by his knowledge and enthusiasm. As a Ph.D. chemist at Dupont, he also had access to many materials. So when my friend, Peter Hotz, and I decided to build and shoot off rockets, my Dad supplied different chemicals and a notebook. With each rocket we built, he would help us construct an explosive recipe. We had to write down the ingredients measuring carefully. He taught us to vary one ingredient at a time and then measure the effects. We recorded everything neatly. By the time he was finished, we had learned the scientific method and we had learned the math of measuring the distance that each rocket traveled. Of course, we also varied the rocket design. It was the way science should be done, passionately and carefully.

There were some experiments that Peter and I didn’t tell him about. Like the time that we built mazes and caught flies to go through them. We found it difficult to measure their progress while they were flying, so we varied the experiment by removing their wings. It’s a little painful to think about those boyish decisions now.

He also had a wonderfully equipped workshop where he built furniture and fixed all manner of things. One of my favorite tools was the lathe. My mother said that she always appreciated my constructions! As time progressed, the combination of the science explorations and the workshop led to many science fair entries culminating in the project that won the Philadelphia Science Fair in my Senior year of high school. For that experiment, I built a Van de Graff generator and ran experiments with it on X-ray transmission rates for thin metal sheets. The generator had a big copper toilet float to collect the static electricity and the X-ray tube was an old medical discard. A Geiger counter with homemade electronics recorded each X-ray photon as it passed through the test sample. It was pretty exciting stuff.

My mother was the unsung hero. She loved parenting the three of us and was always thinking up creative projects. We still watch the home slide shows she made of us and the neighborhood kids acting out fairy tales. She made the costumes, wrote the plays, and drove us to scenic locations around Philadelphia (the haunted house, the secret garden, etc). We all loved them. Except when I was supposed to kiss my sister, Sleeping Beauty, to awake her from the long sleep. I faked that part.

She also supervised our homework and made us feel that doing well in school was a wonderful thing. When I was in junior high school, she arranged for me to go to the Science Library at her alma mater, Swarthmore College. It was a small, beautiful place with wood shelves and books to the ceiling. I relished the time there looking through many books dreaming of when I would be able to really master science and be in the “big time”.

Both of my parents nurtured my dreams and me. It was an idyllic childhood in many ways. We lived in a large somewhat ancient three-story house on 15 acres in Media, Pennsylvania just outside of Philadelphia. Both of my parents grew up in Philadelphia. My father, Robert Fry Engle, Jr., was named after his father who owned a lovely large hotel on the Jersey shore called the Engleside. Summers were spent in Beach Haven and school years in Philadelphia. My Dad didn’t really like the hotel business and told stories about eating in the kitchen with the staff so that he didn’t have to fuss every night with fancy clothes and fancy food. He loved to sail and won many races. We still have silver bowls and dishes from these events. Instead of the hotel business he headed off to Cornell where he earned a Ph.D. in chemistry.

The Engles were a Quaker (Society of Friends) family who emigrated from Cambridge, England in the 1600’s. We assume that they came to escape religious persecution and set up their lives in Pennsylvania with the other Quakers. My great-grandfather, Robert Barkley Engle built the Engleside in 1876. A wonderful history of this has been recounted by John Bailey Lloyd in his book Eighteen Miles of History on Long Beach Island. The hotel was very successful for a time but two things eventually led to its demise. One was the spread of the use of the automobile. Families use to pack up and go to the beach for a month at a time bringing their servants with them. Once the bridges were built and cars became more common (and servants less common), families took shorter vacations bringing fewer people along. The second factor had to do with my grandmother, Sarah Atkinson. As a strict Quaker, she didn’t believe in drinking and insisted that the hotel be dry. This opened up an opportunity for nearby hotels who then benefited from the additional revenue.

My father proposed to my mother on one of the round towers of the hotel. My mother said that she thought she was marrying into a rich family with a wonderful hotel. The hotel went bankrupt and was torn down a mere 4 years later. My father never seemed to regret the demise of the hotel. Probably he was relieved to know that he could proceed with his science and not be called in to take over a business that did not interest him.

Recently, my wife, Marianne and I went to find the location of the Engleside. There is a park and another small hotel (also called the Engleside) on the land. Many of the old-timers recounted stories of the wonderful days of the Engleside. It gave us great pleasure. My mother also told me that she and my father took me to the Engleside when I was a baby just before it closed.

My mother’s family had American, French, and Welsh origins. Her father, William Vernon Phillips, immigrated to Philadelphia as a young man with his three brothers and two sisters. They came from Cardiff and worked in the scrap metal business. Vernon had great success. His import and export iron and steel business, F.R. Phillips and Sons was based in Philadelphia and Milan, Italy. He was also President of the Phillips-Laffitte Company and Chairman of the Board of the Perry Buston Doane Company. He served as mayor of his town, president of his country club, and deacon in his church. During World War I he was Chief of the War Industry Board in Washington, D.C. and on the Council of National Defense. After the Great War, he received the Knight of the Crown of Italy from the King. His obituary called him “an eminent statesman and capitalist.” He was clearly a busy man!

He married Florence Starr, a native of Philadelphia in 1912. They had three children, Billy, Isabel, and Mary whom they nicknamed Murry. In tragic succession, Isabel died of then unknown childhood ailments when she was 7, Billy was killed in an automobile accident when he was 16, and Vernon died of a heart attack in 1931 after the Crash of 1929. Murry and Florence were left on their own. They had to move from their beautiful home to smaller quarters. Murry remembers the sadness and loneliness of this time. One of her favorite memories is of the European tour that she took with her mother when she was 18. The pictures of that trip show a tall, slim beautifully dressed young woman full of charm and grace. She attended Swarthmore College majoring in French and then took numerous postgraduate courses in education at the University of Pennsylvania. Although an Episcopalian, she attended Friends schools throughout her life. When she married Bob Engle, she decided to join him in the Society of Friends and has been active her whole life in the Quaker community.

Once her children were older, she started to teach French at Media Friends School and eventually became its head. She sheparded the school through the addition of a junior and senior high school and a building campaign. She remained on its board for many years contributing both expertise and funds for new buildings and programs.

After she and my father married in 1939, they moved to Syracuse. I was born there on November 10, 1942 and soon after we moved back to the Philadelphia area in Swarthmore. These were happy times. I was named Robert Fry Engle III after my father and grandfather. Small Fry for short! They also had a favorite Springer spaniel named Dukie. My father had taken up ice dancing and there are pictures of my parents skating on ponds and at the Philadelphia Skating Club and Humane Society. They would hook up a record player to a car battery and play music while they skated outdoors.

Two years later, in December 1944, my twin sisters, Patricia Lee (Patty) and Sally Starr were born. It was a shock to have three children. Grandmother Florence Starr (nicknamed Twinkle) helped by taking me over to her apartment where I had a wonderful time visiting the giant steam engine trains and learning card games. In 1947, our family moved a few miles away to a big, old house in Media that the Engles called home until my mother sold the house following my father’s death in 1983.

I was a very active child and adolescent. I loved science, sports, music, and friends. Our yard was so big that we crafted a sloping baseball diamond. After school, my friends would bicycle over and we would play until it got dark or our mothers’ called. Eventually in high school I learned to play lacrosse and played goalie on the high school team. I began to play the tuba in junior high school. My teacher said that any tuba player should also know the string bass! I loved the instrument, took private lessons from Fred Maresch, a bass player of the Philadelphia Orchestra and was named to the All State Orchestra. Later, I played in the symphonies at Williams College, Cornell University, and MIT. Eventually my bass was stolen and I took up the cello. I still have my cello but it doesn’t get much exercise.

I graduated as Valedictorian of Penncrest High School in 1960. Ours was the second graduating class of the newly built school. There are some things that I said in my valedictory address that I still believe. I talked about the need for science to be both relevant and sensitive to the needs of humanity and I emphasized the importance of a balanced life. I am still happiest when I can do research that others can apply widely and when my days have some time for ice dancing or skiing, cultural activities, traveling, and being with my wife and children.

My four years at Williams College were filled with fun, growing up, and more science. I decided to call myself “Rob” as it was more masculine and mature. I still use this today. I majored in Physics, joined the Beta Theta Pi fraternity, and played more lacrosse. In my sophomore year, I was named to the All American Team as a lacrosse goalie, which was quite a thrill. By senior year I was nominated to Phi Beta Kappa. Another delight was roaming all over the countryside going to the women’s colleges looking for dates and parties on the weekends! I seemed to have one close girlfriend each year. Some of my best friends were made in the fraternity house although tragically, two of them, Stan Allen and Dave Kershaw, died young. They would have hooted with pleasure over the Nobel honor.

Academically, I started Physics and Math at the sophomore level since I had done advanced work and lots of outside reading in high school. A small event happened in my senior year that would have great consequences. I could take one more elective to finish out my courses. I almost took the religion course that everyone said was great, but I decided instead to try Introductory Economics. My roommate, Walt Nicholson, and many of my fraternity brothers were economics majors and spent hours discussing economic issues. I loved the course. It was interesting and came easily to me. Who could have predicted that this one elective would later serve as the catalyst that changed the course of my life?

During my senior year, my advisors in Physics encouraged me to apply to graduate school. It seemed natural since I had always dreamed of being a scientist. But something was lacking. I was losing my passion for physics. I did finally apply at the last minute and was accepted at Cornell and UC Berkeley. I called to accept Berkeley, but it was lunchtime. By the time they called back, my advisors had suggested I go to the famous labs at Cornell and so I did, following in my father’s footsteps. I graduated from Williams Cum Laude with Highest Honors in Physics and went off to Ithaca, New York.

Graduate school had its own pleasures. I lived initially in Sage Hall, which was the graduate student dorm. It was wonderful to be on campus with both men and women. I began to date a girl who was an ice skater who took me to the Cornell Figure Skating Club to learn ice dancing. I was very pleased to be in an environment with families and skaters of all ages. As a child my father tried to get me to skate with him, but I had no interest. Now, I needed a new sport since my lacrosse days were over. Ice-skating began to look like a lot of fun. Men are always in short supply in ice dancing so there were plenty of talented pretty girls to help teach me. There was also Eddie Collins, a former Canadian competitor, who took me on as student. The girl friend quit the club and me, but I have enjoyed ice dancing since then.

I worked in Professor Watt Webb’s lab doing low temperature physics and studied quantum mechanics from Nobel Laureate Hans Bethe. Watt Webb was a great advisor with lots of insight and creativity and the study of super-conductivity was certainly exciting. However by mid-year, I realized that I did not want to spend the rest of my life as a physicist. Physics wasn’t what I expected, or maybe, what I expected was what I realized I did not want anymore. Working in the bowels of a building on projects that interested very few people in the world held less interest for me. After agonizing over these feelings and talking to my friends, I approached Alfred Kahn, chairman of the Economics department at Cornell. I asked if his department would be interested in considering me for their Ph.D. program. Serendipitously, he said that an NDEA fellowship had just become available because the intended recipient had turned it down. He offered it to me but said that I needed to make an immediate decision or they would offer it to someone else. My head spinning, I accepted the offer. Now, I had to tell my father and Professor Webb. Both were supportive but with heavy hearts. My father had trained me to be a scientist and now I was leaving for one of those “soft” science fields. At that point, neither he nor I realized how important all that scientific training would be in my contributions to economics.

I loved economics. I attacked it with an energy that I had lost. I took undergraduate classes to make up my deficits in knowledge while I finished my Masters in Physics on using nuclear magnetic resonance to study the performance of a high temperature-superconducting magnet. Intriguingly, both superconductivity and NMR, now named MRI, were awarded Nobel prizes this year! In fact the superconductivity lab next to Webb’s had been honored by the prize in 1996 and they were in the audience this year.

As I began the graduate program, my new advisor, Ta Chung Liu, was in Taiwan working with Chiang Kai Shek on their economic development plan. I took courses in Econometrics from Berndt Stigum where we read Malinvaud in its new English edition, and with John Fei who introduced me to modern microeconomics. My knowledge of math and statistics was put to use instantly. I took Kiefer’s probability and Wolfowitz’s statistics. I was extremely happy.

The next year, Ta Chung was back and I took his Econometrics class which gave me a solid basis for understanding the field. He was working on his third model of the U.S. economy. He had built an annual model and a quarterly model, having beaten the enormous Brookings Project to this goal. Now he was building a monthly model with all the new data and econometric problems that engendered. I learned trade from Ron Jones and Jaroslav Vanek, growth and development from John Fei and economic history from Woody Fleisig. It was so much fun. I found that I could solve the problems easily but quickly got stuck if I needed to formulate a problem. The casual discussions of short run and long run elasticities always required tremendous thought. It was probably ten years before I really absorbed the economic way of thinking.

The years spent in graduate school passed quickly. A few summers were spent in Washington, D.C. at the Bureau of the Budget doing program budgeting. I worked for John Deutsch who later became CIA director. It was there that I first tried to solve a cost benefit problem for public transportation. I recognized that land use was endogenous in the long run and this was critical for the analysis. This was my introduction to urban economics. I met John Kain and Charles Schultz.

As the years passed, my work became more focused on time series econometrics. Ta Chung suggested that I try to theoretically analyze the relationship between the different time scales for economic modeling. I was able to use some of my physics skills by formulating the problem in the frequency domain and applying Clive Granger’s “typical spectral shape” for an economic time series. This was my first introduction to his work.

In January of 1968 another important event occurred. After a ski trip to Aspen, Colorado with friends, I returned to start the second semester. There was a party down the street and a beautiful new young woman caught my eye. She had graduated early from a California college and was just beginning graduate study in Child Development at Cornell. Her name was Marianne Eger and she became my wife in August 1969.

We were first good friends and then I asked her to come with me and my friend Linus Schrage on a week-long canoe trip to the Algonquin Wilderness in Canada. She had never slept in a tent or been in a canoe but she thought it might be fun. Her sense of adventure has been a hallmark of our married life. We love traveling the world, hiking, skiing, and snorkeling while meeting new people and appreciating natural environments. We have come to understand many of the world views that exist on this planet. Our children have embraced the sense of adventure and we continue to have great fun together.

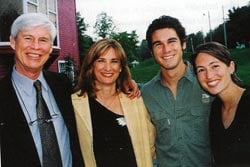

She is also a wonderful intellectual companion and mother. Although I do not understand the intricacies of psychological theory and she, likewise, is not a trained economist, we discuss our ideas and careers with each other at length. And our children, Lindsey and Jordan, are the joys of our lives. I consider myself a very fortunate man.

Marianne was born in Presov, Slovakia and immigrated to the USA in 1949 when she was 2. Her mother, Edith Elefant, grew up in Kosice and was a teenage survivor of Auschwitz. Her parents perished there. She met her husband, Albert Bela Eger, at a recuperation spa after the war. He was a resistance fighter from Presov. After WW II, the Communists made life uncomfortable and they left after an assassination attempt. They were fortunate to receive a visa and joined his brother and her sister in Baltimore, Maryland. They had to leave the Eger fortune behind and like many immigrants, found a way to reinvent their lives. Bela became an accountant, Edith, a bookkeeper. Marianne, meanwhile, went to nursery school. The family moved to El Paso, Texas to pursue more lucrative opportunities. El Paso was good to the family but Marianne was ready to leave. She went to Whittier College on scholarship, graduated early and then went on to a Cornell.

Although our marriage made finishing her Ph.D. more difficult, Marianne did receive it 1978, two years after our daughter Lindsey, was born. She has gone on to have a very successful career as a clinical child psychologist and as a sports psychologist. She has an active speaking career. She even wrote a weekly food column for a number of years.

But I’ve gotten ahead of my story. We married on August 10, 1969. On that day, I turned in my dissertation, received my Ph.D. and we left Cornell for good to take my first academic job at MIT. It was strange to arrive at a place with so many famous economists, none of whom were particularly interested in time series. For one overlapping year, Christopher Sims was at Harvard and a few years later, Jerry Hausman came to MIT. They were both helpful and enjoyable to talk with.

The first summer, 1970, I developed the theory for Band Spectrum Regression and attended the World Congress of the Econometric Society in Cambridge, England. I met economists there who have become lifelong friends and collaborators – Clive Granger, Ken Wallis, David Hendry. I began to go to London and the LSE every chance I could to pursue my fascination with time series. But finding my place was still complicated at MIT.

I enjoyed the teaching and the students there. Many of my students from that time have gone on to do quite well themselves: Larry Summers, Larry Backow, Ric Mishkin, Hal White, and many others. I even received an Outstanding Teacher of the Year Award from the graduate students. But I thought that my research needed a new focus.

Frank Fisher, Bob Solow, and Jerry Rothenberg encouraged me to join them on a new project to build a model of the city of Boston. A fellow economist and friend from Cornell, Tom O’Brien, was research head of the Boston Redevelopment Authority. Over the next 5 years and with many graduate students, the model took shape. I became an urban economist publishing very elaborate statistical models in a field not known for its mathematical sophistication.

Although MIT promoted me to Associate Professor, it was clear that I would not get tenure there. I wanted to work more in time series and I was attracted to Clive Granger’s interest in spectral analysis. At a meeting in Washington, D.C., I asked him if his new university, UCSD, had any openings. He said he’d check and I was invited to La Jolla, California to give a talk there. It was mid-winter, they housed me in a lovely hotel on the beach, a Williams Beta, Dick Attiyeh, was Economics Department Chair, Clive Granger had recently arrived – it was irresistible. I was hired as an Urban Economist and for years I did teach their urban economics course.

It was the beginning of a golden time for time series econometrics. Clive and I began an econometric seminar series, hired Hal White and later Jim Hamilton. We had funding for visitors and the best and brightest came from all over the world. We had numerous visits from David Hendry, Svend Hylleberg, Søren Johannson, Katerina Juselius, Timo Teräsvirta, Ken Wallis, Grayham Mizon, Tony Hall, Adrian Pagan, Max King, Giampierro Gallo, Tony Espasa, Keith MacLaren, Bernt Stigum, Eilev Jansen, Øivind Eitrheim, Helmut Lütkepohl, Hermann van Dijk and many others.

I took a sabbatical at LSE in 1979. Lindsey was then 2 and we rented a lovely row house in Hampstead with a back garden and a study in the back of the first floor. It was there that a new idea came.

I was interested in Milton Friedman‘s conjecture that inflation uncertainty was a central cause of business cycles. Investors who did not know what prices and wages would be in the future might invest less. To test this, a time series model was needed with variances that could change over time. There were two tools that came together to solve this problem. I had done a lot of work with the Kalman Filter and recognized that a one step predictive density would be sufficient to define a likelihood function. The second tool was a test. Clive had recently proposed a test for bilinear time series models. He came by my computer one day before I left and suggested I square the residuals and then fit an autoregression. To my amazement, it was quite significant. I suspected that this test was the optimal Lagrange Multiplier test for some new type of model, but not the bilinear model. I was later to discover that it is indeed the optimal test for ARCH and it is so called today.

Lunch and tea at the LSE were very stimulating times for me. Each day I would get a little further on this new model and would talk with Sargan or Durbin or Hendry or Harvey about its properties and my proofs. David Hendry eventually named it AutoRegressive Conditional Heteroskedasticity and offered to have Frank Srba program it. We applied it to UK inflation data and the ARCH model was launched.

Looking back now, one might think that new ideas are easy to publish. At least for me, they are not. It took quite a bit of rewriting and persuading to finally get it accepted in Econometrica. In fact, I don’t think that any of my papers have had an easy time of it!

Coming back to La Jolla, I was pleased that two events had occurred. The ARCH model was on its way and so was our son, Jordan, who was born in May 1980. I became very interested in Clive’s new concept of low frequency correlation that he called cointegration. It seemed to me that the new tests for unit roots of Dickey and Fuller, which had been so successfully applied by Nelson and Plosser, could be extended to this case. So I constructed an econometric approach to estimation and testing of cointegrated systems. Initially we wrote two joint papers and presented these at a time series meeting at UC Davis. There was a lot of discussion with many opinions as to whether this was a big or a small innovation. We decided to put these together but again, it took rewriting and persuasion, before Econometrica accepted this one too. Clive lost patience and published another version of the paper in the Oxford Bulletin.

Also, my excellent students, Mark Watson and Tim Bollerslev were busy. Mark had carried the Kalman Filter and state space models to a wide range of problems in macroeconometrics. We wrote a paper combining factor analysis and time series modeling and called it DYMIMIC. His first job was at Harvard where he worked with Jim Stock on models of leading indicators. This eventually became an official NBER business cycle forecasting model. Tim took the ARCH model, added a moving average and created GARCH. The GARCH model is an infinite order ARCH model with a geometrically declining set of weights. This extension made the model even more useful. The simplest GARCH model often performs successfully in a wide range of data.

Although these lines of research are now the most visible, there were a lot of other interesting things going on. I had visited LSE in 1975 on a Ken Wallis grant. There I learned about Lagrange Multiplier Tests and wrote a series of papers of which the Handbook of Econometrics survey is the one that gets the most attention. I gave a talk at C.O.R.E. and got into a big argument with Jean Francois Richard on the meaning of exogeneity. Afterward we looked up Koopmans’ definition and realized there were two different notions which we dubbed weak and strong exogeneity. The difference between these two was Clive’s concept of “Granger Causality” which was being used as a test for exogeneity by many authors. We invited David Hendry to join us, added a characterization of “super exogeneity” to deal with the “Lucas Critique” and wrote a quite controversial paper. After the dust settled, the paper was published by Econometrica and the profession has more or less accepted these exogeneity concepts.

Ramu Ramanathan, Clive and I founded a small consulting company, QUERI, that was dedicated to doing econometric research. We spent many happy hours on EPRI (Electric Power Research, Inc.) and other projects working with excellent graduate students to estimate better electricity demand systems, or load factor systems, or weather sensitivity models. These models have found an important place in electric utilities and in EPRI research, but only the spline model done with John Rice has received much academic attention. I wonder whether we would have been involved in the California energy crisis if QUERI had still been in existence?

I loved going to the European meetings of the Econometric Society. Time series was a big part of the program each summer. The meetings were invariably in nice places and we developed long term friendships that were renewed annually. By the mid 80’s these meetings featured multiple sessions on cointegration and ARCH. It was so exciting to see the new directions people were taking this research. We kept working to keep up with these fast flowing fields of research. Each year we would have several students working on these topics. Many of these students have had highly successful careers in and out of universities.

The profession rapidly developed a wide range of extensions of ARCH and GARCH models. Dan Nelson who sadly passed away at a very early age, introduced the Exponential GARCH model called the EGARCH. This model allowed an asymmetric response to returns. This was followed by many versions with names – TARCH, GJR-GARCH, NARCH, VGARCH, APARCH, FIGARCH, FIE-GARCH, STARCH, SWARCH, CES-GARCH, SQGARCH, component GARCH and many more. It was an exciting time. Students such as Gary Lee, Ding, Raul Susmel, Victor Ng, Ted Hong, and Ray Chou contributed to this growing literature.

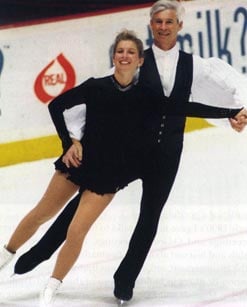

As my research career developed, so did my ice skating hobby. I began skating with Brigit Luciani and we competed in many adult competitions. We often were successful in regional competitions. I passed my gold dance test around 1990 and shortly after that we did a week long workshop with Jane Torvill and Christopher Dean, legendary innovative ice dance champions. Finally, the United States Figure Skating Association agreed to have a national adult skating competition. The first year was 1995 in Wilmington Delaware. There were 21 teams and we eventually ended up 4th. We were very pleased. In 1996 we managed to move up to second place. Later I began skating with Dr. Wendy Buchi and we were again quite successful, placing second in 1999. I’ve had lots of incredible coaches over the years including Barret Brown, Michelle Ford, Jeannie Miley, Kent Weigle, Tatiana Navka, Judy Blumberg, and now Natalia Dubova and Eve Chalom. When I am skating, economics is far away. I always return refreshed and ready to carry on.

Ultimately, my interests gravitated more and more to finance. My colleagues David Lilien and Mike Rothschild and wonderful graduate students, Russ Robins, Victor Ng, Ken Kroner, Mustafa Choudhury and Aaron Smith helped me see this new way of thinking. The trade-off between risk and return was a central feature of financial analysis and the ARCH model had a mechanism for measuring this. We called it the ARCH-M model. A multivariate version with Tim Bollerslev and Jeff Wooldridge generalized the Capital Asset Pricing Model, CAPM. Options markets traded volatility and gave a quantitative validation of the ARCH models. Alex Kane, Jaesun Noh and I explored the possibility of using GARCH to trade options; it was temporarily successful. We flirted with the idea of managing money or investing our own but ultimately didn’t take that route. I ran several conferences in San Diego on the ARCH model designed for both academics and practitioners. I remember being so delighted that finance faculty such as Michael Brennan, Eduardo Schwartz and Bill Schwert came. It was a peek into a new profession. I knew Michael from MIT where I had stepped in to be part of his thesis committee when I first arrived. He was about my age and we still joke about how he is my first student. The rest of the committee was Franco Modigliani and Myron Scholes – a hat trick!

Gradually this new area of research became known as financial econometrics. It is the development of statistical tools specifically designed for financial applications. At conferences and meetings there were now quite a few sessions on financial econometrics. At UCSD we developed a specialization in financial econometrics. The arrival of Bruce Lehman and Allan Timmerman were very important in buttressing the finance side of this research area.

As these ideas spread around the globe, I was increasingly asked to give long workshops or mini-courses. This was fun as a travel experience and introduced me to students I still meet. The first was in Nairobi where Marianne and I were able to spend time with Jim Tobin and his wife. We did a short course at Peoples University in Beijing in 1995 flanked by Gregory Chow and Angus Deaton. Mini-courses in Maastrict, Bagni di Lucca, Helsinki, Uppsala, Madrid, London, Sydney, Stockholm, Vienna, Vaasa, and Rotterdam followed and gave opportunities for me to survey research in particular areas.

Joint work with Sharon Kozicki, Farshid Vahid, Joao Issler and Raul Susmel introduced another idea into econometrics – common features. This is a generalization of factor analysis that has applications to cointegrated systems, multivariate ARCH models and many areas of economics. The goal is to simplify multivariate systems into a small number of variables that endow the system with its typical features. In this case the features are common. This simplifies analysis in a way that is widely used in financial research. I will be surprised if there aren’t important research developments using common features in the next few years.

Somewhat later Simone Manganelli and I developed a new approach to measuring the extremes of a distribution. This method quantifies the probability of large losses on a portfolio by predicting the future quantiles. It has the tastiest name of any of my models, the CAViaR model. It stands for conditional autoregressive value at risk. Peter Hansen came up with this clever mnemonic. The CAViaR model uses the theory of regression quantiles in a time series context to give an updating formula for the Value at Risk (extreme quantile) of a portfolio.

In the early 1990’s I gave my first talks to financial practitioners. In a series of RISK meetings and Q-Group meetings, I introduced the audience to ARCH models and learned about the fascinating questions facing practitioners doing risk management and derivatives trading. I began a consulting project at Salomon Brothers in building seven of the World Trade Center. This project with Joe Mezrich and Eric Sorensen was to incorporate the GARCH model into a series of client oriented trading systems. Volatility forecasts and trading strategies were proposed based on innovative models. Advanced software developed by Pat Burns and Aslihan Salih, was used to structure client and proprietary portfolio strategies. I learned a great deal from this experience and made many contacts throughout the financial world.

I was asked to serve on the steering committee of a Zurich Financial Services company, Olsen and Associates, who were doing path breaking work on the analysis of very high frequency financial data. They were partly data vendors who delivered tick by tick currency and other data to a collection of European clients, and partly model builders. Richard Olsen and Michel Dacarogna proposed joint academic/practitioner conferences on the use of these data. In the first high frequency data conference, the same data set was analyzed by statisticians, economists, physicists, financial practitioners, and traders. The comparison was fascinating and highly informative.

Jeff Russell and I wrestled with the question of what we could learn from such high frequency data. Every way of handling the data in calendar time involved a loss of information. One day we realized that we could treat the time between trades as a random variable itself and model the speed of trading. We developed the Autoregressive Conditional Duration or ACD model for this purpose. It is a Poisson process with an intensity that is conditional on the past information. Financial data show variations in trading rates that can be called duration clustering. The model we proposed had the same structure as the GARCH model and recognizes the close relation between trading intensity and volatility. The simple ACD(1,1) very rapidly led to generalizations with different functional forms, error densities and types of data. Initially we only observed quotes so we built a model for the time it took for prices to move a fixed amount. The ACD model of such price durations is really an alternative volatility model. Then we obtained transactions data and modeled the time between trades. In the Fisher Schultz Lecture that I gave in Istanbul, I combined the time between trades and the prices at which trades occurred into an “ultra high frequency” or tick by tick GARCH model.

Although there was a lot of interest in the statistical model of trade arrivals, some economists at the time thought this was a model of the least interesting variable in finance. I was convinced that the trading frequency measured a fundamental heartbeat of financial markets. Clearly it reflected the flow of information. It turns out also to be closely related to measures of liquidity. I began reading the literature on market microstructure and soon came to Maureen O’Hara and David Easley (1992). Maureen was also on the Olsen steering committee and I recognized that the speed of trading was related to information flow in their model and had a direct link with measures of liquidity such as bid-ask spread and price impact. In papers with Alfonso Dufour, Joe Lange and Andrew Patton, we showed that when markets are more active, in the sense that the time between trades is short, they are less liquid. Information flows correspond to illiquid markets over time.

This research leads naturally to an interest in timing of trades to achieve good execution. Several years later, a group at Morgan Stanley headed by Robert Ferstenberg and Rohit d’Soza approached me and I have spent many interesting days with them developing a microstructure approach to optimizing and evaluating trades. We have become good friends as we push this frontier between theory and practice.

New York was a very exciting place to visit when I was consulting for Salomon. Now that Lindsey and Jordan were both on their own, I convinced Marianne to spend the fall semester of 1999 visiting NYU in the finance department. I knew many people there. My sister, Patty, had also moved there to work as the child development officer for UNICEF. Joel Hasbrouck was the leading microstructure econometrician; Steve Figlewski, who was a student of mine many years ago at MIT, was a leading empirical options researcher, and my recent student Josh Rosenberg was there. The semester was too short. I saw the financial markets at work and got to know more finance faculty. We ate well and played hard. When NYU offered me a permanent position, I took it and we moved in September 2000. I thought we would stay for only a year, but even that was not enough. Eventually I retired from UCSD, becoming an emeritus professor. We maintain close ties with San Diego as we have a house there where we spend summers and have lots of friends. UCSD has kept my office and I still see a few students.

Since I have been in New York, my work has actually moved back to volatility models, but in large multivariate systems. The extension of ARCH models from univariate processes to multivariate processes began in the early 1980’s. Ken Kroner and I introduced one new family, he and Victor Ng introduced another and Tim Bollerslev introduced a third. However, there have not yet been many empirical applications of these models. This is because they are difficult to specify, estimate and interpret. In a new general class of models called Dynamic Conditional Correlation or DCC models, I have developed a potential solution. This class is parsimonious and appears to give satisfactory performance for both small and large systems. In a series of lectures at Erasmus University in May 2003, this model was fully described and these lectures will soon appear as a Princeton University Press monograph.

To evaluate alternative covariance matrices, I have developed a loss function with Riccardo Colacito, based on the effectiveness for asset allocation. The same model can be applied to Credit Risk as the correlation between defaults is determined by the dynamic structure of the covariance matrix and the tail properties of the model. New high frequency volatility models have come out of research with Giampiero Gallo and models for the volatility of volatility have been developed with Isao Ishida. The new and interesting research topics that have opened up since I have been in New York are a constant source of stimulation.

While professional interests have always been important in my life, so have my family and my hobbies. Marianne and I have had a wonderful busy time raising Lindsey and Jordan. We stay as close as we can to them and over the years they have traveled with us all over the world. Lindsey was always a fine student and devoted ballerina. Her warm, friendly personality and her strong determination have led to much success for her and a good time for us. She has been a wonderful sister to her younger brother. When she was a baby, she would come to my office one day a week and sleep on a mat behind a chair to take her nap. She would come to lunch with Clive and the other economists. Unfortunately, all that good input didn’t lead to a career in economics! She graduated from Princeton Cum Laude in anthropology and has now finished a Ph.D. in developmental psychology at UCLA. In May, 2003, she married Justin Richland, JD, a legal anthropologist from Los Angeles, also finishing his Ph.D. They both hope to have careers in academia.

Jordan is the outgoing charmer. He is a wonderful athlete, excellent soccer player, and has a probing mind. He graduated from Williams College in English literature with a certificate in theater and is now in Los Angeles working as an actor and cinematographer. During his college years, he spent 2 semesters at the University of Cape Town, South Africa. He was very affected by the country and its people. Our trip with him to Botswana was a highlight for us. Jordan can talk to anyone comfortably and learn about them. He is also an excellent writer. His career path will be an interesting one. As a brother and a son, he is a pleasure for all of us. He has had lots of girlfriends and was especially sorry that the Swedish princesses did not seem interested in him!!

My sisters Sally and Patty have also had very successful careers and I am so proud of them. It is remarkable how many parallels there are among us. I guess it must be something about either genetics or our upbringing. Sally received her Ph.D. in anthropology and has been teaching at Wellesley for 30 years. She developed an interest in the relation between legal systems and cultural systems. This lead to books on Urban Danger in Boston, the ways of Getting Justice and Getting Even in and outside the Massachusetts court system, law, culture and the U.S. colonization in Hawaii, human rights and the U.N. and lots of papers with sharp insights into modern society. She was president of the Law and Society Association and a regular visitor at the American Bar Foundation. She is now being courted by NYU and the University of Pennsylvania. Maybe there will be another Engle in New York.

Patty received her Ph.D. in psychology at Stanford and has spent a career studying cross cultural child development focusing often on the role of nutrition. She has been involved in projects in Guatemala, Nicaragua, Peru, Uganda, India, and many other places. Her academic publications describe many of these research settings; her students and colleagues at her long time university, California State University at San Louis Obisbo, were able to hear about these first hand. Her current position as Senior Advisor for Child Development at UNICEF in New York gives her scope to pursue the goal of child health from a broad perspective. She has become a vocal advocate for global children as she works to improve the quality of life in so many different cultures.

Rob and Wendy Buchi in National Adult Ice Dance competition in Lake Placid 1997.

A stable, happy home life is good for all of us and allows us each to focus on our careers knowing that when we are back together, there is more to share. As a family we love food, wine, music, opera, art, theater, traveling, hiking, fishing, and watching sports. Separately we have our individual career paths and our hobbies. It makes for a rich interaction. I still ice skate 2-3 times a week. I enjoy skating with Wendy Buchi when I am in La Jolla. Marianne is learning to play golf. Lindsey runs with her dogs, Jordan finds soccer games and surfs when he can.

The Nobel Prize in Economics is an incredible recognition for the work that my students, colleagues and I have done over the years. We all worked hard but we were also lucky that the financial applications were so important. It continues to amaze me how far this simple idea has traveled. I am starting a Financial Econometrics Research Center at NYU to foster the continuing development of this field.

As I look back over my career, this Prize is the high point. I find myself reflecting with great affection on smaller, perhaps less dramatic, moments. These are moments of insight; moments that started a new research topic or recognized a connection between things previously thought to be distinct. These are also moments of family time – wonderful moments with Lindsey and Jordan, sharing ideas, eating, hiking, skiing and yes, even fishing – and moments with my lifelong companion and soul-mate, Marianne. It has been already a lengthy and varied career but I think I am only part way through it. There are many exciting adventures in our future and I am looking forward to ever so many special moments more.

This autobiography/biography was written at the time of the award and later published in the book series Les Prix Nobel/ Nobel Lectures/The Nobel Prizes. The information is sometimes updated with an addendum submitted by the Laureate.

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.