Award ceremony speech

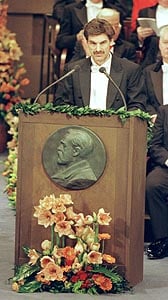

Professor Torsten Persson delivering the Presentation Speech for the 1999 Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel at the Stockholm Concert Hall.

Copyright © Nobel Media AB 1999

Photo: Hans Mehlin

Presentation Speech by Professor Torsten Persson of the Royal Swedish Academy of Sciences, December 10, 1999.

Translation of the Swedish text.

Your Majesties, Your Royal Highness, Ladies and Gentlemen,

The advancement of science frequently relies on new methods that allow us to approach questions no one has been able to answer in the past. Scientific breakthroughs also occur when creative researchers ask new questions that no one was imaginative enough to formulate in the past. The ability to pose new questions is perhaps particularly important in economics and other social sciences. Society undergoes constant transformation, due to changed institutions, behavior and expectations. In other words, the social sciences necessarily attack moving targets.

Successful researchers thus establish new methods which turn out to have a lasting impact, or they pose new questions which are one step ahead of social development. In several papers, published in the early 1960s, Robert Mundell succeeded in doing both.

This year’s Laureate formulated a new framework, the so-called Mundell-Fleming model. He used it to show how the short-run effects of monetary and fiscal policy in an open economy hinge on the international mobility of capital. He also demonstrated the importance of the exchange rate regime: under a floating exchange rate, monetary policy becomes a powerful means of stabilizing the economy, whereas fiscal policy becomes powerless. The opposite is true under a fixed exchange rate.

In contrast to his colleagues in the field, Mundell’s research did not stop at short-run static analysis; he formulated dynamic models to deal with the economy’s adjustment over time. He analyzed the mechanisms through which prolonged balance-of-payments deficits and surpluses occur and are gradually eliminated. Mundell also examined ways in which monetary and fiscal policy can be decentralized, by asking: how might instability in the economy be avoided over time if each of these instruments is directed toward either of two objectives, external and internal balance?

The new methods had a rapid and far-reaching impact on research. Today’s standard methods in international macroeconomics are thus deeply rooted in Mundell’s work.

But this year’s Laureate also posed new questions with uncommon accuracy, particularly in terms of the future development of monetary arrangements and capital markets. In the 1960s, almost all countries were linked together by fixed exchange rates within the so-called Bretton Woods System. Despite this, Mundell devoted an equal share of his analysis of economic policy to the regime of floating exchange rates. At this time, international capital movements were highly restricted, largely due to extensive exchange controls. Mundell nevertheless examined what the effects of economic policy would be when there is high capital mobility between countries. According to the prevailing view of economic policy, the prerequisite for a successful outcome was that the government gathered all economic-policy instruments in a single hand. Mundell broke with this tradition and analyzed the possibilities of decentralizing monetary policy to the central bank. The academic literature as well as the practical debate regarded it as self-evident that each nation should have its own currency. But Mundell posed a radical question about “optimal currency areas”: under what circumstances is it advantageous for a number of regions to relinquish their monetary sovereignty in favor of a common currency?

These problems might have seemed like an academic curiosity 35 years ago. But reality eventually caught up with Mundell’s analysis. The Bretton Woods System broke down in the early 1970s and an increasing number of currencies began to float freely. International capital markets gradually opened up and are now gigantic. Today, many central banks are independently responsible for price stability. And many countries – even outside Europe – have formed, or contemplate forming, a currency union. Hence, Mundell’s research foreshadowed social development. As a result, it has also had a strong impact on economic policy considerations in practice.

Dear Professor Mundell: The methodology you introduced several decades ago still forms a solid foundation for research and teaching in international macroeconomics. Indeed, your contributions reshaped this field. The questions you asked anticipated important changes in monetary arrangements and capital markets with almost prophetic foresight. Thus, your work is a superb reminder of the importance of basic research. It is a great honor and a privilege for me to convey to you, on behalf of the Royal Swedish Academy of Sciences, our warmest congratulations. I now ask you to receive the Prize from the hands of His Majesty the King.