Award ceremony speech

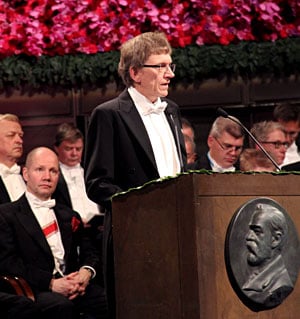

Professor Bertil Holmlund delivering the Presentation Speech for the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2010 at the Stockholm Concert Hall.

Copyright © The Nobel Foundation 2010

Photo: AnnaLisa B. Andersson

English

Swedish

Presentation Speech by Professor Bertil Holmlund, Member of the Royal Swedish Academy of Sciences, Chairman of the Economics Sciences Prize Committee, 10 December 2010

Your Majesties, Your Royal Highnesses, Laureates, Ladies and Gentlemen,

In the economic sciences there is a classic view of the market as a place where a large number of buyers and sellers meet and can trade with each other. They find each other without cost and have full information about the prices of all goods and services. Prices are determined in such a way that supply will equal demand. In this equilibrium, both buyers and sellers are “satisfied”, in the sense that they can carry out the transactions they are looking for.

But many markets do not work this smoothly. It often requires time and effort for a buyer and a seller to establish contact and reach agreement on the terms of a transaction. In the labour market, such search frictions result in the simultaneous occurrence of unemployment and job vacancies. It takes time for job seekers to find work, and firms can typically not fill their vacancies immediately.

Peter Diamond, Dale Mortensen and Christopher Pissarides have developed a theory of markets with search frictions. This theory is relevant in many markets. For example, it applies to the housing market, where many households are searching for new homes at the same time as a large number of houses and flats are being offered for sale. Search theory can also be used to study how spatial frictions and transport costs affect residential patterns and business location decisions, and even how matching takes place in the marriage market. However, the most important application is in the labour market.

The Laureates have shown that price and wage formation in a search market may sometimes lead to outcomes that are radically different from what we would expect from conventional theory. They have also shown that resource utilisation in a search market is generally not socially efficient, since there are indirect effects that individual agents do not take into account. If one unemployed person increases her own search activity, it will become more difficult for other job seekers to find employment. At the same time, it will be easier for a recruiting firm to fill its vacancies. Since these indirect effects are not taken into account by individual agents, there is generally scope for government intervention aimed at achieving welfare improvements.

The Laureates’ model of the labour market characterises the search activity of the unemployed, the recruiting behaviour of firms and wage formation. The model can be used to study how the level and duration of unemployment, the number of job vacancies and the real wage are determined. For example, what role is played by the design of unemployment insurance, the efficiency of employment agencies and regulations on firing and hiring?

The effects of unemployment insurance have been extensively studied. The theory implies that more generous benefits bring about longer search time for the unemployed and higher unemployment − a relationship that has received support in many empirical studies. However, unemployment insurance can also facilitate efficient matching between job seekers and vacancies, so that the “right person” ends up in the “right place”.

But questions about how unemployment insurance should be designed can of course not be answered without also weighing in the fact that this insurance provides income protection to those who have been laid off. Search theory has also proved to be a highly useful tool for such welfare analyses of alternative designs of unemployment insurance.

Dear Professors Diamond, Mortensen and Pissarides.

Your research on markets with search frictions has had a profound impact on how economists view markets in general and labour markets in particular. You have provided detailed models of how prices and quantities are determined in markets with frictions and how frictions affect unemployment and other labour market phenomena. Your models have become indispensable tools for policy analysis and your work has initiated a large empirical literature.

It is an honour and a privilege to convey to you, on behalf of the Royal Swedish Academy of Sciences, our warmest congratulations. I now ask you to receive your Prize from the hands of His Majesty the King.

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.