Popular information

Information for the public:

Markets with search costs (pdf)

Populärvetenskaplig information:

Marknader med sökkostnader (pdf)

The Prize in Economic Sciences 2010

Why are so many people unemployed at the same time that there are a large number of job openings? How can economic policy affect unemployment? This year’s Laureates have developed a theory which can be used to answer these questions. This theory is also applicable to markets other than the labor market.

Markets with search costs

According to a classical view of the market, buyers and sellers find one another immediately, without cost, and have perfect information about the prices of all goods and services. Prices are determined so that supply equals demand; there are no supply or demand surpluses and all resources are fully utilized.

But this is not what happens in the real world. High costs are often associated with buyers’ difficulties in finding sellers, and vice versa. Even after they have located one another, the goods in question might not correspond to the buyers’ requirements. A buyer might regard a seller’s price as too high, or a seller might consider a buyer’s bid to be too low. Then no transaction will take place and both parties will continue to search elsewhere. In other words, the process of finding the right outcome is not without frictions. Such is the case, for example, on the labor market and the housing market, where searching and finding are essential features and where trade is characterized by pairwise matching of buyers and sellers.

This year’s Laureates have enhanced our understanding of search markets. Peter Diamond has made significant contributions to the fundamental theory of such markets, while Dale Mortensen and Christopher Pissarides have further developed search theory and made it applicable to analysis of the labor market. The three laureates’ achievements help us to comprehend a number of important economic questions in general, and the determinants and development of unemployment in particular.

The basic idea in search theory is that participants in a market look for cooperative partners in order to implement joint projects. This may involve simple cases of a buyer and a seller of a product, as well as more complex relations between employers and job seekers or between firms and their suppliers.

As usual in the case of basic research, there are many conceivable areas of application. The housing market, for instance, is a clear-cut parallel to the labor market in that both the number of vacancies and the time it takes to sell a home vary over time. Search theory has also been used to study issues in monetary theory, public economics, regional economics and family economics.

The theory takes shape

In the 1960s, researchers had already begun to use mathematical models to study the best possible way in which a buyer can try to find an acceptable price. In a renowned article from 1971, Peter Diamond examined how prices are formed on a market where buyers look for the best possible price and sellers simultaneously set their best price while taking buyers’ search behavior into account. Even small search costs turned out to generate a radically different outcome compared to the classical competitive equilibrium. In fact, equilibrium prices are equal to the price which a monopolist would have set on a corresponding market without search costs. This result attracted considerable attention and initiated intensive research on search markets.

Several important studies on search and matching markets were published around 1980. Peter Diamond, Dale Mortensen and Christopher Pissarides examined the properties of the various markets. They provided new answers to many unsolved issues and could also pose completely new questions which earlier research had not been able to formulate.

Two key insights emerged from this work. First, a search market is characterized by so-called external effects which are not taken into consideration by individual agents. If someone who is unemployed increases his, or her, search activity, it will become more difficult for other job seekers to find employment. At the same time, it will be easier for a recruiting firm to fill its vacancies. These external effects are not taken into account by an individual job seeker. In a number of studies from the 1980s, the three Laureates showed that, in general, an unregulated search market does not give rise to an efficient outcome. Resource utilization might be too low, although under some circumstances it could also be too high, since search and matching processes are associated with real costs.

The second insight concerns a related question. In the classical model of competition, the unregulated market outcome is both unique and efficient. But in a world with search costs, there can sometimes be several possible market outcomes. This was shown by Peter Diamond, who also pointed out that only one of these outcomes can be the best. This, in turn, implies that there is reason for governments to try and find ways of inducing the economy to move towards the best outcome.

Theoretical research on search and matching markets has helped us understand the economic principles underlying phenomena such as price and wage dispersion and unutilized resources.

A model for the labor market

In a number of studies, Dale Mortensen and Christopher Pissarides have systematically developed and applied the theory to examine the labor market – particularly the determinants of unemployment. This has resulted in a model known as the Diamond-Mortensen-Pissarides (DMP) model. Today, the DMP model is the most frequently used tool for analyzing unemployment, wage formation and job vacancies.

The DMP model describes the search activity of the unemployed, the recruiting behavior of firms and wage formation. When a job seeker and an employer find one another, the wage is determined on the basis of the situation on the labor market (the number of unemployed workers and the number of vacancies). The model can thus be used to estimate the effects of different labor-market factors on unemployment, the average duration of spells of unemployment, the number of vacancies and the real wage. Such factors may include the benefit level in unemployment insurance, the real interest rate, the efficiency of employment agencies, hiring and firing costs, etc.

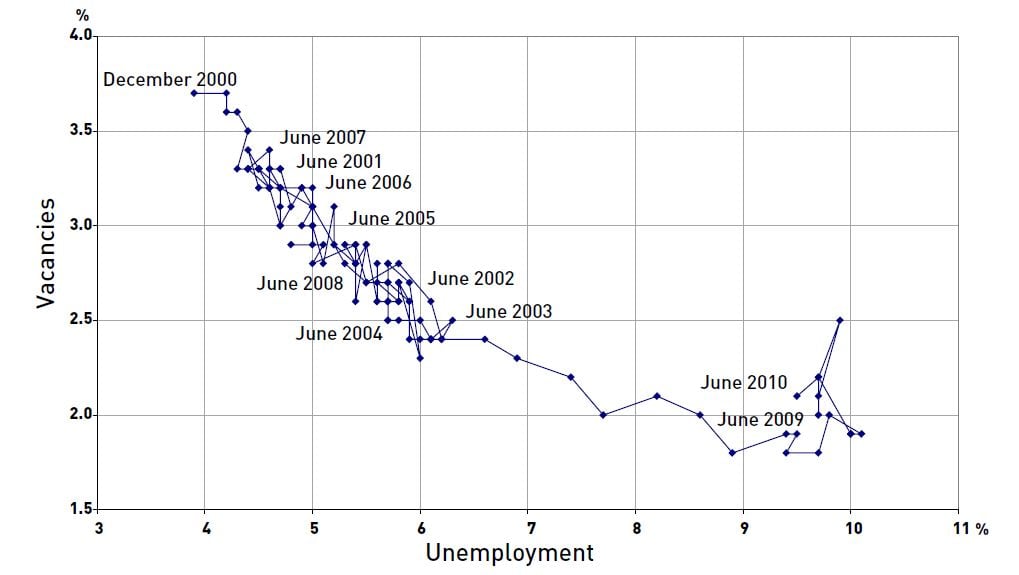

It has been known for a long time that the labor market fluctuates between situations of either high unemployment and few vacancies or low unemployment and many vacancies. This empirical pattern, known as the Beveridge curve due to the British economist William Beveridge, is illustrated in figure 1, based on data on the U.S. economy in the 2000s. The DMP model provides a theoretical explanation for the Beveridge curve.

The DMP model can be used to explain the position of the Beveridge curve and the location of the economy on the curve. If unemployment and vacancies move in opposite directions, then changes can be regarded as reflecting variations in the demand for labor which occur over a business cycle. However, if unemployment and vacancies increase simultaneously, it is instead more natural to pursue an explanation in terms of changes in the performance of the labor market. One reason could be weaker matching efficiency, i.e., longer durations of unemployment in a given market situation. Another explanation could be more rapid structural changes that increase the rate at which firms lay off workers. Such developments on the labor market could be a sign that long-term unemployment will increase. The DMP model has turned the Beveridge curve into a widely used diagnostic tool for empirical labor-market analysis.

Search and matching theory is used extensively in theoretical and empirical studies of the effects of unemployment insurance. The theory states that more generous benefits bring about higher unemployment and longer search time for the unemployed – a relationship that has also received strong empirical support. The theory has also become highly useful for welfare analyses of alternative designs of unemployment insurance. In order to determine the structure of such insurance, the welfare gains it provides in terms of income security when laid off also have to be taken into account. The insurance can also facilitate efficient matching between unemployed workers and vacancies (“the right person in the right place”).

Search theory has emerged as the predominant model for considering the effects of economic-policy measures on the labor market. It also enables us to analyze many other social phenomena.

Links and further reading

Review articles

Andolfatto, D. (2008) Search models of unemployment. The New Palgrave Dictionary of Economics. Second Edition. Eds. S. N. Durlauf and L. E. Blume. Palgrave Macmillan. doi:10.1057/9780230226203.1497

Diamond, P. (2008) Search theory. The New Palgrave Dictionary of Economics. Second Edition. Eds. S. N.

Durlauf and L. E. Blume. Palgrave Macmillan. doi:10.1057/9780230226203.1498

Mortensen, D. (2008) Labour market search. The New Palgrave Dictionary of Economics. Second Edition.

Eds. S. N. Durlauf and L. E. Blume. Palgrave Macmillan. doi:10.1057/9780230226203.0917

Petrongolo, B. and Pissarides, C. (2001) Looking into the Black Box: A Survey of the Matching Function,

Journal of Economic Literature 39: 390–431.

Rogerson, R., Shimer, R. and Wright, R. (2005), Search-Theoretic Models of the Labor Market: A Survey,

Journal of Economic Literature 43: 959–988.

Books

Diamond, P. (1984) A Search-Equilibrium Approach to the Micro Foundations of Macroeconomics, MIT Press, Cambridge, MA, pp. 74.

Mortensen, D. (2005) Wage Dispersion: Why Are Similar Workers Paid Differently?, MIT Press, Cambridge, MA, pp.157.

Pissarides, C. (2000) Equilibrium Unemployment Theory. Second edition. MIT Press, Cambridge, MA, pp. 252.

The Laureates

PETER A. DIAMOND

Department of Economics, Massachusetts Institute of Technology,

50 Memorial Drive Cambridge, MA 02142-1347, USA

http://econ-www.mit.edu/faculty/pdiamond

US citizen. Born 1940 in New York City, NY, USA. Ph.D. 1963, Institute Professor and Professor of Economics, all at Massachusetts Institute of Technology, Cambridge, MA, USA.

DALE T. MORTENSEN

Department of Economics, Northwestern University,

2001 Sheridan Road, Evanston, IL 60208, SA

http://faculty.wcas.northwestern.edu/~dtmort

US citizen. Born 1939 in Enterprise, OR, USA. Ph.D. 1967 from Carnegie Mellon University, Pittsburgh, PA, USA. Ida C. Cook Professor of Economics at Northwestern University, Evanston, IL, USA and Niels Bohr Visiting Professor in Economics at Aarhus University,

Denmark.

CHRISTOPHER A. PISSARIDES

Department of Economics, London School of Economics and Political Science,

Houghton Street, London WC2A 2AE, UK

http://personal.lse.ac.uk/pissarid

British and Cypriot citizen. Born 1948 in Nicosia, Cyprus. Ph.D. 1973, Professor of Economics and Norman Sosnow Chair in Economics, all at London School of Economics and Political Science, UK.

© The Royal Swedish Academy of Sciences

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.