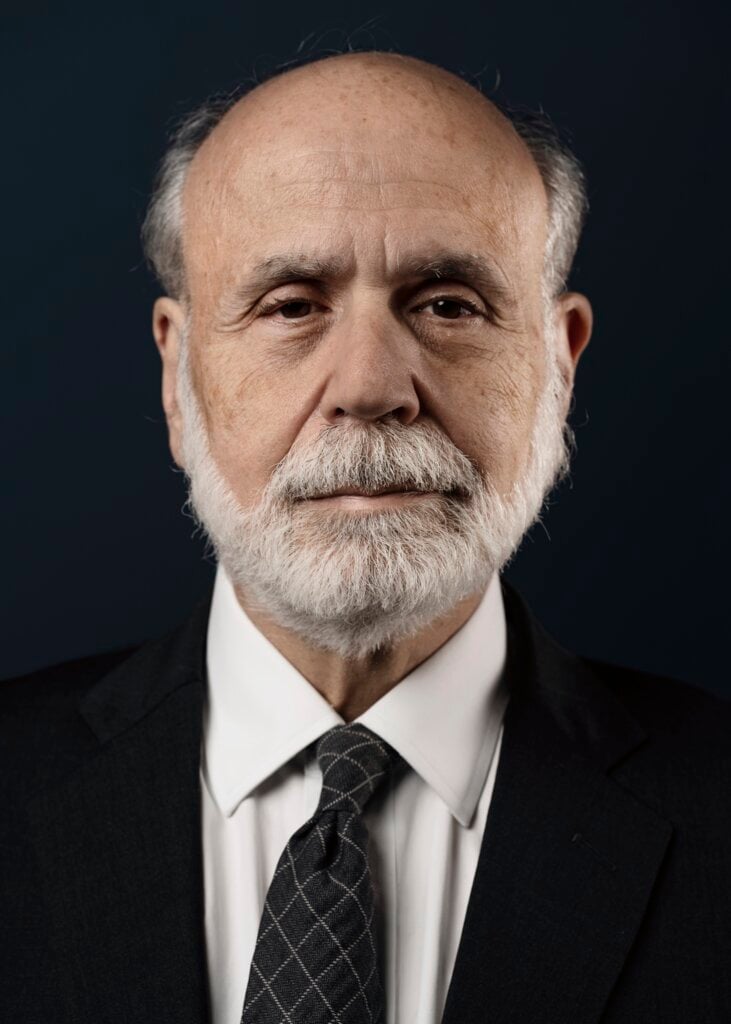

Ben Bernanke

Biographical

Iwas born December 13, 1953, in Augusta, Georgia, but spent my childhood and teenage years in Dillon, South Carolina. Dillon, a town of about 6,000 people, lies just west of the Little Pee Dee River, in the northeastern part of the state. When I lived there, the area was mostly dependent on agriculture – cotton and tobacco – although for a time there also was textile manufacturing. In the 1950s and 1960s, other than high school football, Dillon had little to offer in terms of services or entertainment. A visit to an optometrist or an evening at the movies required a trip to the larger city of Florence, about 30 miles away. Dillon’s main claim to fame when I was living there, and perhaps still today, was South of the Border, a sprawling Mexican-themed tourist attraction just south of the North Carolina state line. Many travelers on I-95 on their way to Florida would be entertained by the pun-filled billboards advertising South of the Border (“Try our honeymoon suite: It’s heir conditioned!”) that lined the highway. I was a serape-clad waiter at one of South of the Border’s four restaurants for several summers during my college years.

Family Background

My grandparents were all Jewish immigrants from eastern Europe. My mother’s parents, Herschel and Masia Friedman, emigrated from Lithuania around the outbreak of World War I. They lived in Maine and then Connecticut – where my mother, Edna Friedman, was born – before making a permanent home in Charlotte, North Carolina. Herschel worked as a kosher butcher and Hebrew teacher; Masia stayed at home with my mother and her brother Dan but was active in the family’s synagogue.

My father’s parents, Jonas and Pauline Bernanke, arrived in the United States a few years after the Friedmans. Jonas served as a corporal in the Austro-Hungarian army during World War I. When I was a young boy, he told me many romantic tales of his adventures. I know for sure that he was captured by Russian forces, escaped during the chaos of the Russian revolution, made his way somehow to Shanghai, and from there took a steamer to Marseilles. He married Pauline, known as Lina, and together they emigrated to the United States, via Ellis Island, in 1921. In New York, Jonas studied pharmacology, while Lina, who had earned a medical degree at the University of Vienna (one of the first women to do so), established a practice on the Lower East Side. My father, Philip Bernanke, was the second of three sons. Fred was older, Mortimer was younger.

Following several unsuccessful attempts at starting his own pharmacy in New York City during the Great Depression, Jonas brought the Bernanke family south after he saw an advertisement in a trade magazine about a pharmacy for sale in Dillon. He bought it, moved the family, and opened Jay Bee Drugs – the name based on his initials – in 1941. Jay Bee Drugs proved successful and sustained the family for many years, but the cultural shock of moving from New York to Dillon in 1941 (my father was a teenager) must have been tremendous. Lina was particularly opposed to the move, since South Carolina did not recognize her medical credentials. But Jonas insisted.

My father, Philip, and my mother, Edna, met when both were attending college in North Carolina. My father was a drama major, and he briefly tried to make a go of it as a director of local theater groups. He was often an artistic success but an economic failure. When I was born, adding to the family’s financial responsibilities, he changed careers. At the time, one could become an accredited pharmacist through experience and by passing a test, with no special schooling required. Philip passed the test and went to work for his father. Eventually he and his brother Mortimer bought Jay Bee Drugs from their father and were partners until they retired. My mother briefly taught elementary school and did back-office work in the store as well, but for the most part she stayed home with her children. My younger brother Seth was born in 1958 and my sister Sharon in 1960.

Theater had been my father’s first choice of occupation, but he made a success of the pharmacy. In a town with no hospital and typically only one or two practicing doctors, many people went to Doctor Phil and Doctor Mort, as my father and uncle were known, for advice on health and nutrition. Their business was built on close personal relationships with customers. Jay Bee Drugs gave credit to customers who could not pay, offered free deliveries of prescriptions, and opened for emergency prescriptions at any time, day or night. They treated White and Black customers with equal respect, unusual in a place and time of extreme segregation and racial discrimination. My father’s empathy with customers was so strong that, though born and bred in New York, he would unconsciously lapse into a heavy Southern accent and mannerisms when he spoke with them.

Early Years

Although I saw my paternal grandparents frequently – they lived in Dillon – I was closer to Herschel and Masia. From age four or five, I would visit them in Charlotte for several weeks every summer. On pleasant summer evenings I would sit with them on the front porch. I credit a conversation I had with my grandmother when I was very young with piquing, very subtly, what would later become my strong interest in the economics of the Depression. Masia told me about living in Connecticut during the Depression. She was proud that Herschel was able to earn enough that they could buy new shoes for their children for school each fall. Other children had to go to school in worn-out shoes or, according to my grandmother, sometimes even barefoot. When I asked her why their parents didn’t buy those children new shoes, she said their fathers had lost their jobs when the shoe factories closed. “Why did the factories close?” I asked. She replied, “Because nobody had any money to buy shoes.” Even at six years old I could see the paradox, and I would spend much of my professional career trying to resolve it.

I attended public schools in Dillon through high school. In the sixth grade I won the state spelling bee and went to the finals in Washington, my first airplane ride. (I was eliminated in Washington after I misspelled the word “edelweiss,” a Swiss flower.) I learned the saxophone and marched with the high school band at football games. As a senior I won a statewide academic award; the prize was a seventeen-day guided bus tour through a half dozen European countries – my first time abroad. The summer after my senior year I worked as an unskilled construction laborer. Together with my later restaurant work, it gave me an appreciation of how hard most people must work to support their families.

In South Carolina at the time, White and Black students attended separate schools. In Dillon, that did not change until I became a senior, when I attended a newly built, now integrated, high school. In a segregated society, most of my friends and acquaintances were White. A life-changing exception was Kenneth Manning, a Black friend, a few years older than me. We met because his family frequently shopped at Jay Bee Drugs. A brilliant student, Ken was a Harvard undergraduate when I was a high school senior. He believed that, instead of attending a nearby college, as my parents had planned and I had assumed, I should go to Harvard as well. The question was whether my parents would allow me to go. They were concerned about the cost and the long distance (both geographically and socially) from Dillon to Boston. Ken made several visits to our home to try to persuade my parents. Ultimately, he won them over. I was accepted by Harvard and entered in 1971. I promised my parents I would help relieve the burden of Harvard’s tuition, which led to my summers waiting on tables at South of the Border. Ken Manning went on to become a professor at MIT, where he specializes in the history of science.

College and Graduate School

I was excited to be at Harvard (and in Cambridge) but was woefully underprepared. My background was deficient, especially in math, and I didn’t know how to study, never having had to do so in high school. And I had no real idea of what I was good at or in what I should major. My first semester was especially difficult for me, and by Christmas break I considered dropping out. But with time to reflect at home, I resolved to do better. With time I began to acclimate to the coursework and college life and to enjoy the stimulating atmosphere of Cambridge.

My intellectual tastes were eclectic (or, less charitably, unfocused). I took math and science courses, including statistics; some history; and a variety of liberal arts courses, including art, literature, and philosophy. I liked everything and changed my mind about what I would major in multiple times. In my sophomore year, I took Economics 10, Harvard’s famous introductory course, de rigueur for practically all undergraduates. The well-known economist Martin Feldstein lectured in a big auditorium to probably a thousand students. More-personal instruction occurred in small breakout classes that met a couple of times a week. My section leader was Lee Jones, now at Boston University. Jones was interested in the economics of growth and development and helped me see that good economics could potentially improve the lives of millions of people. At a personal level, I saw that the field would allow me to use my skills and interest in math, statistics, history, and philosophy. I decided to make economics my major.

As a junior I had taken a course in econometrics from Dale Jorgenson, a prominent professor, and on an impulse one day I walked into his office and asked for a summer job. I don’t know to this day why he took a chance on someone with so limited a background. But he would end up hiring me for the next two summers. As part of Jorgenson’s team, I helped write FORTRAN programs to simulate econometric models Jorgenson had developed to study the economic effects of changes in energy prices and supplies. Our tools and methods were advanced for the time but today seem very primitive. We fed punch cards into a card reader, and it was not unusual for a program to take several hours to run. But it was my first taste of real economic research and whetted my interest for more.

Jorgenson, who died in 2022, was a wonderful mentor throughout my career. He advised my senior thesis, in which I studied the interaction of energy production with the larger economy. I integrated Jorgenson’s model of the economy with various sectoral models of energy production (coal, oil, electricity) developed by others. My thesis won Harvard’s top undergraduate prize in economics, and I graduated summa cum laude and Phi Beta Kappa, a big improvement over my slow start. With Jorgenson, I cut the thesis down to article length and in 1975 we published it as a jointly-authored article – my first professional publication. Putting my interests over institutional loyalty, Jorgenson advised me to do graduate work at the Massachusetts Institute of Technology, rather than Harvard. At the time, MIT, with luminaries like Paul Samuelson (a Nobel laureate), and future Nobelists Robert Solow and Franco Modigliani, was considered the strongest economics graduate program in the world. I very much enjoyed my time there. I remained in contact with Jorgenson for the rest of my professional career, however, often turning to him for advice and encouragement.

After graduating from Harvard in 1975, I went directly to MIT. Once again, I struggled with uncertainty about what to study. I asked Stanley Fischer, my first-year macroeconomics professor, for advice. He gave me a copy of A Monetary History of the United States, 1863–1960, by Milton Friedman and Anna Schwartz, a thick and rather dry tome that made the historical case for a strong link between the money supply and business cycles. “Read this,” he said. “It may bore you to death. But if it excites you, you might consider doing monetary economics.” I was fascinated. I was especially interested in the chapters on the Depression, which the authors attributed to monetary factors. If monetary economics could help explain the Depression, the most important economic event of the twentieth century, it seemed worth studying. The book, together with my economic history course with MIT’s Peter Temin, reawakened an interest in the Depression that I could trace back to the conversation with my grandmother many years earlier.

Stanley Fischer advised my dissertation, along with Rudiger Dornbusch and Solow. Fischer was an excellent advisor, widely read and skilled at helping students develop their research ideas. He also had a good sense of how academic economics could inform policy. He went on to become the governor of the central bank of Israel, and subsequently, the vice chair of the Federal Reserve under Chair Janet Yellen. Like Jorgenson, Fischer kept in close touch with me throughout my career and provided helpful advice and support, including during my own time as a policymaker. I was fortunate indeed to have two such accomplished and helpful mentors.

In 1977, when I was a third-year graduate student, I met my future wife, Anna Friedmann, a senior at Wellesley College near Boston. The daughter of Holocaust survivors, Anna grew up in Denver and had come to Wellesley on a full scholarship. She majored in chemistry to please her parents, but her real love was Spanish literature, in which she minored. Spanish was her fourth language, after English, Italian, and Serbo-Croatian. She went on to earn a master’s degree in Spanish literature at Stanford and later work as a high-school Spanish teacher.

My roommate and his girlfriend, also a Wellesley student, arranged for Anna and me to meet on a double date with them. We fell for each other immediately, and after a rapid courtship, we were married on Memorial Day weekend the next year – May 29, 1978. Anna graduated from Wellesley two days before the wedding, allowing her parents to make one trip for both events. We have been married now for more than 44 years. Our son Joel was born in 1982 and our daughter Alyssa in 1986. Joel is a child and adolescent psychiatrist, and Alyssa is in her residency at Northwestern’s medical school.

My MIT dissertation was three essays on macroeconomics (a common format for dissertations at the time). The lead paper (“Irreversibility, Uncertainty, and Cyclical Investment”), which would be published in the Quarterly Journal of Economics in 1983, showed that a firm’s ability to make an irreversible capital investment should be thought of as an option, in the financial sense of the word. In particular, it may be optimal for firms to delay irreversible investments to gain more information – that is, not to exercise their option to invest – when there is unusually high uncertainty, even if many of the possible outcomes are favorable. The paper concluded that, even when the fundamentals are strong, high uncertainty can generate an economic downturn. My dissertation did not include any reference to the Depression. But I continued to read and think about why the global economic collapse of the 1930s was so long and so deep.

Stanford

After graduation from MIT in 1979, I accepted an assistant professor position at Stanford’s Graduate School of Business. The possibility of working with faculty in both the business school and the Stanford economics department, both of which were among the world’s best, appealed to me. I learned a great deal from my colleagues during my six years at Stanford. Particularly important, as it turned out, the Stanford business school was a hotbed of work on the economics of imperfect and asymmetric information. The Stanford faculty included Robert Wilson and Paul Milgrom, later to be named Prize laureates, as well as David Kreps and John Roberts, all of whom helped develop the theory of how markets work when one party to a transaction has more, or different, information from the other. They and others showed that imperfect information can significantly affect market functioning and the incentives of market participants. In this they built on other exciting work, including a classic contribution (“The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism,” Quarterly Journal of Economics, 1970) by future Nobel laureate George Akerlof of the University of California, Berkeley, which showed how asymmetric information between sellers and buyers could, under some circumstances, cause a market to collapse completely. Figures such as future Nobel laureate Joseph Stiglitz applied the economics of imperfect information to better understand important markets, like the markets for loans, insurance, and health care.

My exposure to the new work on asymmetric information helped me clarify my thinking about the Great Depression, a subject that had continued to intrigue me. In my 1983 paper cited by the Committee (“Non-monetary Effects of the Financial Crisis in the Propagation of the Great Depression,” American Economic Review), I reviewed the extraordinary distress experienced by both lenders and borrowers during the Depression, including the bank runs that shut down thousands of U.S. banks and the widespread defaults by homeowners, farmers, and firms. Using insights drawn from the literature on imperfect and asymmetric information, I then argued that this extreme financial distress caused banking and credit markets to break down. The resulting damming of credit flows, I wrote, supplemented the monetary forces emphasized by Friedman and Schwartz as a principal source of the Depression. I noted that credit disruptions, especially those associated with banking crises, could help explain why a potential economic recovery in late 1930 and 1931 was aborted; why credit in the United States fell much faster than output in the 1930s; why price deflation was so damaging (it bankrupted debtors, like farmers, whose incomes fell with prices but whose financial obligations did not change); why, following the bank holiday and institution of deposit insurance in 1933–34, the economy began a strong recovery; and why the subsequent economic recovery was so slow (banks continued to be cautious and it took a long time to work out problems of borrower insolvency).

The 1983 paper included no formal model and only limited econometric analysis, but it was fruitful in that it led me to pursue two related lines of research. First, with Mark Gertler (and, later, with Gertler’s student Simon Gilchrist), I developed the implications of imperfect information in credit markets for the behavior of the broader economy. For example, we showed theoretically and empirically how variations in credit conditions could amplify economic fluctuations – an effect that became as the financial accelerator (see, for example, Bernanke, Gertler, and Gilchrist, “The Financial Accelerator and the Flight to Quality,” Review of Economics and Statistics, 1996).

A key insight from our work was that increases in the net worth (wealth) of borrowers better align the incentives of borrowers and lenders, reducing the cost to lenders of extending credit. For example, a bank will be more willing to lend to a small business owner who has a large equity stake, knowing that the substantial investment of the borrower in their business will incentivize the borrower to work hard and to avoid unnecessary risks. The financial accelerator effect arises when a weakening economy lowers the net worth of borrowers, which makes lending riskier and more costly for banks, which in turn worsens the downturn (the accelerator effect). The same dynamic in the opposite direction works to amplify economic booms. Gertler, Gilchrist, and I would later show how to incorporate the financial accelerator into an otherwise standard quantitative new Keynesian model of the economy (“The Financial Accelerator in a Quantitative Business Cycle Framework,” in Handbook of Macroeconomics, 1999).

Moreover, banks and other lenders are themselves borrowers, since they must raise funds from deposits or in capital markets in order to lend. Thus, lenders’ financial health (as reflected, for example, in the level of bank capital) also affects credit market outcomes. In particular, financially weak banks, who fear the loss of short-term funding (through a run, for example) will make fewer and less risky loans (the flight to quality). Importantly, this line of research provided a framework for thinking about large, endogenously determined financial crises (Bernanke and Gertler, “Banking and Macroeconomic Equilibrium,” in New Approaches to Monetary Economics, 1987), a framework that would be substantially elaborated in Gertler’s subsequent work with Nobuhiro Kiyotaki (“Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy,” American Economic Review, 2015). Financial crises are of course an important practical concern for policymakers. In a 2018 paper (“The Real Effects of Disrupted Credit: Evidence from the Global Financial Crisis,” Brookings Papers on Economic Activity), I showed empirically that, in analogy to the Great Depression, increases in financial distress during the Global Financial Crisis were closely linked to subsequent declines in U.S. economic activity and employment.

Gertler and I used related models to study the so-called credit channel of monetary policy transmission. Several authors (a recent example is Gertler and Peter Karadi, “Monetary Policy Surprises, Credit Costs, and Economic Activity,” American Economic Journal: Macroeconomics, 2015) have shown empirically that the effects of monetary policy on the economy work largely through changes in credit conditions. Anticipating these results, in a 1995 paper (“Inside the Black Box: The Credit Channel of Monetary Transmission,” Journal of Economic Perspectives), Gertler and I argued that the logic of the financial accelerator applies to monetary policy shocks as well. For example, an unexpected easing of monetary policy, by strengthening the economic outlook and raising asset prices, improves the financial conditions of both borrowers and lenders. That improvement in turn stimulates credit extension and economic activity. We called this mechanism the credit channel of monetary policy.

The second broad line of research that followed from my 1983 paper was further investigation of the causes of the Depression, including cross-country comparisons. My articles on the Depression are collected in Lessons from the Great Depression. In this book, I contributed to the developing consensus that the breakdown of the interwar gold standard was a major cause of the global Depression, and I dug into the behavior of wages and employment during the 1930s. Providing empirical support for the 1983 paper, with Princeton historian Harold James (“The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison,” in Financial Markets and Financial Crises, 1991) I did an empirical cross-country study that found that the severity of the Depression in twenty-four countries depended primarily on two factors: (1) how long the country remained on the gold standard after the Depression began (staying on the gold standard led to more severe deflation and depression); and (2) the severity of the banking crises in the country, which in turn depended on structural factors, such as whether the country had many small banks, as in the United States. In several other papers, I would use the comparative approach to examine alternative explanations of the Depression and the persistence of high unemployment in the 1930s.

Princeton

Both Stanford and Princeton offered me full professorships in 1985. Both were attractive, but my wife and I chose Princeton (Anna saw its leafy environs as more conducive to family life). I remained on the Princeton faculty, jointly appointed in the economics department and the Woodrow Wilson School of Public Affairs, until I entered government service in 2002. I was chair of the economics department from 1995 to 2002. On three occasions I was a visiting faculty member at MIT, my doctoral alma mater. I also established strong connections with regional Federal Reserve banks, including those in Boston, New York, and Philadelphia.

At Princeton I began or continued several other lines of research. First, I made early contributions to what is now a very large and vibrant literature on the identification of the economic effects of unexpected changes in monetary policy. For example, in a 1992 paper (“The Federal Funds Rate and the Channels of Monetary Policy,” American Economic Review), my Princeton colleague Alan Blinder and I, building on work by future Nobel laureate Christopher Sims, estimated the macroeconomic effects of monetary policy shocks on the economy. One of our key assumptions was that monetary policy shocks can be equated with unexpected changes in the federal funds rate, the Fed’s main policy interest rate. With my student Ilian Mihov (“Measuring Monetary Policy,” Quarterly Journal of Economics, 1998), I developed alternatives to the federal funds rate as an indicator of monetary policy, which accounted for changes in the Federal Reserve’s operating procedures. In a precursor 1986 paper (“Alternative Explanations for the Money-Income Correlation,” Carnegie-Rochester Conference Series on Public Policy), I showed that vector autoregression (VAR) methods could accommodate additional assumptions about the structure of the economy. So-called structural VAR models are now widely used in macroeconomics.

Monetary policy, in practice, is made using large amounts of economic data, a fact which is not easily reconciled with VAR approaches that focus on the dynamics of only five or six variables. In work with Jean Boivin (“Monetary Policy in a Data-Rich Environment,” Journal of Monetary Economics, 2003) and with Boivin and Piotr Eliasz (“Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach,” Quarterly Journal of Economics, 2005), I showed how to incorporate information from a large set of variables into otherwise parsimonious vector autoregressions. The paper with Boivin and Eliasz introduced the use of factor-augmented vector autoregressions (FAVAR), in which the dynamic factor that best describes the common movements of a long list of data series is estimated along with the VAR. Overall, the current state of the art in measuring the effects of monetary policy has built on the papers noted above, along with other foundational research. However, in an important improvement, the most recent articles use unexpected changes in federal funds rate futures and other financial indicators in a short window of time (e.g., thirty minutes) around the Fed policy announcement to measure policy shocks more accurately. In a forthcoming paper in the Journal of Economic Perspectives (“Risk Appetite and the Risk-Taking Channel of Monetary Policy”), Michael Bauer, Eric Milstein, and I use this methodology (known as high-frequency identification) to study the effects of monetary policy shocks on investors’ risk appetite. We find that monetary easing tends to induce investors to take more risks in financial markets.

Another area of research to which I have contributed is the positive and normative study of central bank communication, particularly the pros and cons of setting an official inflation target as an instrument for communication and transparency. Much of my work in this area was with Frederic Mishkin (see for example our articles in the 1992 NBER Macroeconomics Annual and in the 1997 Journal of Economic Perspectives). In this line of research, my coauthors and I considered the experiences of central banks outside the United States with formal inflation targets. We argued that adoption of a target by the Federal Reserve, together with supporting communication such as economic forecasts, would increase the Fed’s public transparency and accountability.

Later in my career I also became interested in how monetary policy could retain its potency when the short-term policy rate reached its effective lower bound (typically zero). In my first year as a Fed governor, in 2002, I gave a speech which laid out some possible strategies. I did empirical work on the subject in a 2004 paper with Vincent Reinhart and Brian Sack (“Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment,” Brookings Papers on Economic Activity), summarized in a short 2004 paper with Reinhart (“Conducting Monetary Policy at Very Low Short-term Interest Rates,” American Economic Review Papers and Proceedings). Broadly, I argued that monetary policy should retain considerable scope to stimulate the economy even when short-term rates were zero and could not be reduced further. I have continued to write about alternative monetary policy tools, such as quantitative easing and forward guidance, including in my American Economic Association presidential address (“The New Tools of Monetary Policy,” American Economic Review, 2020) and my recent (2022) book, 21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19.

The Federal Reserve and Council of Economic Advisers

In 2002 I was appointed by President George W. Bush to a seat on the Federal Reserve Board. In 2005 I moved over to the White House, becoming the chair of the president’s Council of Economic Advisers. Later that year, with the retirement of Alan Greenspan pending, Bush nominated me to be the chair of the Federal Reserve, effective in January 2006.

My time as chair was eventful, to say the least. It included the 2008–2009 global financial crisis, the subsequent European debt crisis, and most of the Great Recession and the associated recovery. I have provided detailed discussion of my experience at the Fed in my memoir (The Courage to Act, 2015) and elsewhere. Here I will just note that my academic research informed my policy decisions in important ways.

First, my work on the Depression and on the financial crises convinced me that a collapse of the financial system would have disastrous effects for the whole economy, not just Wall Street. Working with Treasury Secretary Henry Paulson, as well as with New York Fed President and later Treasury Secretary Timothy Geithner, in 2008-09 I worked to prevent that collapse. Many of these rescues were very unpopular. Bailing out failing financial firms and other efforts to contain the crisis were often seen as rewarding the malefactors who caused the problem. But I believed they were necessary for economic as well as financial stability. Except for the critical but unavoidable failure of Lehman Brothers in September 2008, our stabilization of the financial system largely succeeded, and the crisis was mostly contained by the spring of 2009. The economic recovery began soon after. Although our interventions in the financial system, together with unconventional monetary policies, ensured that I would remain a controversial figure, President Obama’s decision to renominate me was an important mark of confidence. I was also named the Time magazine person of the year for 2009 and received other, more academic, recognitions, including appointment to the National Academy of Science.

A second influence of my academic research on policy was that, following Friedman and Schwartz, I believed that helping the economy recovery would require a very accommodative monetary policy. The federal funds rate hit zero in the fall of 2008. Thus, providing more stimulus required alternative tools, tools that I had studied before becoming chair. In 2009 my colleagues and I introduced the first of several rounds of large-scale asset purchases (quantitative easing), and we used forward guidance to persuade markets that monetary ease would continue for a while, which helped create more supportive financial conditions and strengthen the recovery.

In keeping with my work on inflation targeting and central bank communication, I was able to make the Federal Reserve much more transparent during my tenure. We instituted a formal inflation target, significantly expanded our public forecasts (including forecasts of the policy interest rate) and began conducting press conferences by the chair following policy meetings, among other innovations. These changes, taken still further by my successors, have changed the character of the Fed and its relationship with the public.

The Brookings Institution

Since leaving the Federal Reserve in 2014 at the end of my second four-year term as chair, I have been a senior distinguished fellow at the Brookings Institution, a think tank in Washington. My wife runs a small private school in Washington, called Chance Academy, which works mostly with underserved children. She and I have worked together to support the school. I have remained professionally active, writing two books and various articles, focused mostly on aspects of monetary policy. Work I did with John Roberts and Michael Kiley of the Federal Reserve Board on optimal policy at the zero bound (“Monetary Policy Strategies for a Low-Rate Environment,” AEA Papers and Proceedings, 2019) influenced the development of the Fed’s average inflation targeting policy framework, announced in August 2020.

In 2018, I was elected president of the American Economic Association for 2019. The principal objective of my tenure was to make the economics profession more welcoming to women and minorities. We appointed an ombudsman that AEA members could consult on issues of discrimination or harassment; and we created programs to encourage undergraduates to major in economics, to set best practices for economics departments, and to mentor young female and minority professionals. The extent to which these efforts will bear fruit remains to be seen.

I continue to live in Washington with my wife Anna and our corgi cattle dog, Duchess. Both of our children are married and attended the Stockholm ceremonies with their spouses.

© The Nobel Foundation 2023

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.