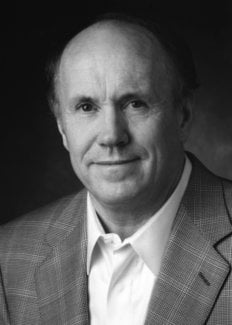

Edward C. Prescott

Biographical

I was born on December 26, 1940, in Glens Falls, New York, to Mathilde Helwig Prescott and William Clyde Prescott. My mother’s parents were German immigrants. My mother was forced to drop out of high school at age 16 to care for her younger brother and sister after the death of their mother. Later, she managed to complete high school, and with the help of a family friend (whose name I wish I could remember) she continued with school and became a librarian. My mother’s ambition and fortitude, even in hard times, were exceeded only by her generosity and kindness. My father told me it was she who insisted that he return to Penn State University to complete his education. He had dropped out of college in 1932 when his father lost his job in the Great Depression.

My father had dreams of being a writer, but ended up becoming an industrial engineer. Upon graduation from Penn State in 1935, he found a good job at the Imperial Wallpaper and Pigment Company in Glens Falls, New York. In 1935 he and my mother were married; a year later, my brother William III was born. My sister Prudence came next, in 1939. I was the third and last child. I was a shy and not very social child. I had dreams of doing something special. When a challenging problem came up, I attacked this problem with intensity until I solved it. We lived in Glens Falls throughout my childhood, except for two and a half years during World War II when my father worked for a defense firm in Bristol, Pennsylvania.

My father taught me how to play chess and we played until I gained the upper hand. History has a way of repeating itself. I taught my oldest son how to play chess when he was young and we played often until he became a much better chess player than I. My father and I also played golf. We had similar temperaments and this temperament was not that of a good golfer. We each got upset when we made a bad shot and you cannot play golf well when you are upset. I must admit that I derived great pleasure from the rare occasion when I beat him.

My father’s company was acquired by Hercules Chemical, a multinational corporation, in the early 1960s. At the end of that decade my parents moved to Wilmington, Delaware, where my father became the comptroller of its international division. He retired and moved back to Glens Falls in 1974. Through discussions with him, I learned a lot about the way businesses operated. This was one reason why I liked my microeconomics course so much in my first year at Swarthmore College. The price theory that I learned in that course rationalized what I had learned from him about the way businesses operate. The other reason was the textbook used in that course, Paul A. Samuelson’s Principles of Economics. I loved the way Samuelson laid out the theory in his textbook, so simply and clearly.

One thing that I remember from discussions with my father was the importance one person can have for the success of an organization. There was one such person, George Mellon, at my father’s company. Mellon built Imperial into the dominant pigment producer in the world. George Mellon was just one of those special people that could make good things happen.

Glens Falls is an interesting small town located in the foothills of the Adirondack Mountains on the Hudson River. The town was once wealthy with lumber money. Residents chose not to let the railroad connecting Montreal and New York pass through the town, as that would detract from the community. Glens Falls had a number of high-tech businesses, including Imperial, which through research and development became the leading pigment producer in the world. There were also a number of small electronic and medical equipment firms, as well as an insurance company, a paper mill, and the capacitor division of General Electric Co.

In high school I spent a lot of time playing bridge at the home of a friend. I remember two large sculptures by David Smith that decorated the living room. I know these artworks were special because a dozen years later I saw them at a special exhibition of Smith’s work in Washington, D.C. Douglas Crockwell, the father of this friend, was a famous illustrator who was a distant second to Norman Rockwell in the number of covers done for the Saturday Evening Post. He showed me drawings that he prepared for the famous physicist Edward Teller. Not being an atomic physicist, they didn’t mean much to me.

Another friend’s father was a leading orthopedic surgeon who worked out of New York City, although he also had a local practice. He experimented with hypnosis in his local practice, and he let us watch when he hypnotized a patient. I tried to hypnotize someone once and was successful, but one time was enough. With its high-tech industries and interesting set of talented residents, Glens Falls in many ways was not a typical American small town.

But in many other ways, it was. We all played Little League baseball, played pickup basketball after school, and went skiing. There were Friday and Saturday community activities in town for the young people. The high school had an exceptional science program headed by Mr. Bosworth. A math course I vividly recall as special was Miss Mabel’s plane geometry course. There I discovered a new “language” and learned the concept of a proof. The other math courses were good, but they were not the same. When I received a 99 on one of the New York State Regent Exams in mathematics (not plane geometry), Miss Mabel had tears in her eyes. She so much wanted me to have perfect scores in all the math exams! I felt bad about letting her down.

My goal was to make the high school basketball team, but being the second smallest and second youngest in my class of 160 put me at a disadvantage. I have always loved a challenge, so this didn’t discourage me from sports. By the time I reached my senior year I had grown some (weight: 133 pounds) and made the varsity football team. I was a pretty good defensive back and the second-string quarterback. Our team was loaded with talent and easily won all our games. This experience was not exciting. There was no challenge. I also was a good pole vaulter, setting the school record in my senior year. This was a challenge and even though no one was concerned with pole vaulting except me and my coach, I was happy with myself that I met this challenge. I had other interests as well: I was an avid reader of science fiction and was enamored with the writings of the Fabian Socialists. I also played tournament bridge.

During the summers my friends and I all held jobs. I became a golf caddy when I was 12 and a camp counselor for troubled kids when I was 17. When I returned from college in the summers I worked in the paper mills, which paid well. This helped pay for college, but more importantly, I got to know, like, and respect my fellow workers who didn’t have the opportunities I had.

Back in 1958, it was not hard to get into even the most prestigious universities. But I decided to go to Swarthmore College because it was less intimidating and somewhat less expensive than the Ivy League universities. Many years later my father told me that my mother had been disappointed in my decision. She had hoped that I would choose a more prestigious institution, but I have never been concerned with social status and prestige.

In high school I dreamed of being a rocket scientist, and therefore I majored in physics in college – probably the most demanding major at that time, given this was the Sputnik era. What disappointed me about Swarthmore was the dearth of intellectual discourse. Fellow students spent much of their time memorizing, rather than thinking and figuring things out. Nearly all were too idealogical to carry on an intellectual discussion. I could always predict what they would say. How anyone could defend the killing of tens of millions by Stalin and Mao was (and is) beyond me. This experience cured me of my socialistic leanings.

I have always had a need for physical activities and challenges. In college I played football for four years, and was the captain in my senior year. I enjoyed this diversion. Most of my teammates were the “non-intellects” – the engineers and premeds at Swarthmore. They had positive, cooperative attitudes and we worked well as a team. Winning or losing did not matter as much as playing as well as we could.

I dropped out of the physics honors program after my third year because I did not like the day-long laboratories. I liked to create things, and I found it difficult if not impossible to be careful and meticulous. Perhaps if the physics program had been more theoretical, I would have ended up a physicist rather than an economist. In my junior year I had taken an advanced seminar with the math honors students and liked it, so I switched to a math major in my senior year. That year I took a fascinating course in engineering economics taught by the charismatic professor Sam Carpenter. This led me to enroll in graduate school in operations research at Case Tech, which subsequently merged with Western University to become Case Western. I had no financial aid except for free room and board provided by a benefactor of Case. Given my financial situation, I worked intensely and completed the two-year master’s degree program in 15 months. It was all work and no play, but what I learned in the operations research program at Case proved to be of great value in subsequent years. In particular, I learned some recursive methods in the queuing theory course and thoroughly enjoyed learning some probability theory in a course that used the Feller’s classic text.

After earning my master’s degree, I had to decide what to do next. If MIT had offered aid, I would have gone there. But they didn’t, and the choice was between staying at Case or going to the Graduate School of Industrial Administration (GSIA) at Carnegie Tech (now Carnegie Mellon University) in Pittsburgh, Pennsylvania. I am not sure what led me to the decision that I made, but I chose GSIA with its multi-disciplinary program. In hindsight it was the right decision.

I truly enjoyed my graduate school days at GSIA. I arrived there as a student the same year Robert E. Lucas, Jr. (the 1995 Nobel Laureate in Economics) arrived as a freshly minted assistant professor. Under GSIA’s system, there was an informal assignment of students to faculty. I was assigned to Michael C. Lovell, who became my dissertation advisor – although Morris M. DeGroot, a great statistician, played an important role in supervising my research. Mike and I wrote two joint papers, one on an interesting mathematic statistics problem and the other on developing a business cycle model.

I learned something else from Mike that turned out to be important for the success of my career. I learned from him how to help students in that very difficult transition from student to researcher. What is the key in this transition is that students gain confidence in their own judgment and that they learn to listen to, and even seek, criticism of their research papers. I think a number of my students have benefited from interacting with me. I know I have benefited greatly from interacting with them. When my former students contribute to the advancement of economics, I take great pleasure in their success.

I did not take many economics courses at GSIA, but the capital theory of Bob Lucas was important, as was the growth theory course that Mike Lovell and Mort Kamien taught. I took a number of courses outside of GSIA, and the one taught by Allen Newell, one of the fathers of artificial intelligence, was exciting. The reason I took Newell’s course was that I found what Herbert A. Simon (1978 Nobel Laureate in Economics) said about artificial intelligence fascinating. Herb was a person who forced you to think and to take clean positions. With exceptional minds like these around, GSIA was an intellectually exciting place to be.

There was considerable interaction between the younger faculty and the graduate students. Bob Lucas, a junior faculty member, and I became lifelong friends. Much of the interaction occurred during the coffee times at 10:30 and 3:30. You could be certain Bob would be there, and the discussion would concern economics, broadly defined.

While at GSIA I received a generous fellowship and I worked hard. Having found a good group of friends, I partied hard as well. In September of 1964 I met Janet Dale Simpson. We were married June 5, 1965, the day before she graduated from Chatham College. Meeting Jan alone made my decision to go to GSIA the right one. There also were sporting activities, which I love. Carnegie Tech had an exceptional intramural program, and we doctoral students along with some master’s students had highly competitive teams in most sports. I even realized my high school dream of playing on a good basketball team! One year we were the intramural champions; another year we lost in the finals by two points.

After three years at GSIA, I left to join the faculty at the University of Pennsylvania in Philadelphia. There, my oldest son, Edward Simpson Prescott, and my daughter, Wynne Fraser Prescott, were born. The Penn years were good ones, though I must admit to a fear that I would not make it as a professor. The junior faculty members were bright and talented; I learned a lot from them. I have a great debt to Lawrence R. Klein (1980 Nobel Laureate in Economics), who provided summer support. I like models of the macroeconomy, and Larry Klein more than anyone is responsible for the development of this interest.

I benefited greatly from interaction with Larry Klein, and even more from Ned Phelps. He had the vision of the neoclassical synthesis; namely, providing the economic foundations for macroeconometric models. Ned posed the questions that had to be answered to unify macroeconometric models with the rest of economics. He ran the famous Conference on the Micro Foundations of Wage and Price Determination at Penn in 1969. Bob Lucas and a number of other people whose research was germane to this topic were there.

At the conference, Bob and I talked about the dominant firm problem in industrial organization and thought we had it solved. We ran into problems, however, and given that we were committed to presenting a paper at the summer Econometric Society meetings, we had to write something else. The paper we wrote in 1969 was “Investment under Uncertainty.” To deal with this partial equilibrium problem, we embedded it in a general equilibrium framework.

In this framework the number of commodities was large, too many to even be counted. This is when I was introduced to Gerard Debreu‘s classic paper1 on valuation equilibrium and Pareto optimum. Debreu’s paper is less than five pages. The mathematics is beautiful. Each of the minimal number of assumptions is clearly specified and the welfare theorems established. I realized an economy that did not have the required mathematical structure with a given set of traded commodities often has the required structure with a richer set of traded commodities. This theory makes transparent Arrow-Debreu general equilibrium theory with event-contingent commodities. I learned that apparent market failures often disappear when mutually beneficial trades are not prohibited. This simple insight has been crucial in some of my most important papers. The Debreu paper makes clear the importance and power of good language.

Writing the “Investment under Uncertainty” paper transformed me into an economist. Before that I was more a statistician than an economist. I am an econometrician in Ragnar Frisch’s original sense of the word; namely, someone dedicated to making neoclassical economics quantitative.

Among the highlights of my Penn experience was my interaction with one of the students there – Tom Cooley, who was (and remains) a family friend, and who subsequently became a valued collaborator. His dissertation supervisor was Larry Klein, but I also played a role in the supervision, and I like to take some of the credit for Tom developing into an exceptional economist.

In 1970 I was on leave as a Brookings Economic Policy Fellow assigned to the U.S. Department of Labor. When I returned, Penn had two new young faculty members that I came to admire greatly. They were Steve Ross and Tom Sargent. With colleagues like this, Penn was a very good place for me to be, but I was worried that I might not be granted tenure. When Richard Cyert, Dean of GSIA at Carnegie Mellon, called and made an attractive offer, I accepted.

Upon arriving at GSIA I met two advanced graduate students, Costas Azariadis and Finn Kydland. Even though they were more my colleagues than my students, I became their dissertation advisor and, like Tom Cooley, they became lifelong friends. The Ph.D. program became an exciting one. Credit for this goes to a number of people. David Cass and Bob Lucas played crucial roles and I think I did too.

After only one year, Dick Cyert moved to the presidency of Carnegie Mellon University, where he was critical in transforming it into a major research university. He is another example of one person being responsible for something happening. But even though this move was clearly good for the university, it was not good for GSIA. A dean who did not appreciate what he had (and did not understand the great tradition of the school) took actions that resulted in the departure of Dave Cass and Bob Lucas. I was saddened to see something good destroyed.

In 1973 our youngest son, Andy, was born. We joined the Chapel Gate Swimming and Tennis Club. I played tennis frequently. During this time tennis was how I got my exercise.

Jan, having an adventuresome soul, decided we would spend 1974-75 in Bergen, Norway, at the Norwegian School of Business and Economics, where Finn Kydland had become a faculty member. One thing that made it an adventure was that none of us spoke Norwegian and there were no English-speaking schools in Bergen. The visit turned out to be both personally and professionally rewarding. In the spring of 1975, Finn and I returned to the problem of policy selection in dynamic, uncertain environments. This time we got it right and found that the principle of optimality fails. Macro policy is a game, not a control problem as we had thought.

After returning from Norway, I decided to leave Carnegie Mellon as soon as a good opportunity arose. Finding a good match was not so easy, though. I was then established as an econometrician and was informally offered a good position in that area. But, I was no longer an econometrician. I found economics much more exciting, and upon my return to GSIA I chose not to teach the graduate econometrics course and instead taught an industrial organization course. A number of my students wrote innovative dissertations in this area. This was the rebirth of the field of industrial organization. The dissertations of Therese Flaherty, Chandra Kanodia, Charles Holt, Jean-Pierre Danthine, Edward Green, Barbara Spencer, Thore Johnsen, Léon Courville, and of course Finn Kydland, were all in this area. I wrote a couple of industrial organization papers with Michael Visscher, an assistant professor at Carnegie Mellon.

During this time I collaborated with Rajnish Mehra, the only Carnegie student other than Finn with whom I collaborated. In late 1979 we wrote “Equity Premium Puzzle” (which appeared in 1985) and “Recursive Competitive Equilibrium.” The shift from trying to come up with models that fit the data to using theory and measurement to provide quantitative answers to questions was difficult for me, given the way I was programmed to think.

A bumper crop of exceptional economists came on the market in the mid- 1970s, and Carnegie Mellon was fortunate to hire some of them. Upon my return I introduced a regular faculty seminar for these young faculty members. One of them, Rob Townsend, significantly altered my thinking about economics. He was a Neil Wallace student, and therefore one who uses the general equilibrium paradigm (as I do). But, he had been influenced by Leo Hurwicz’s mechanism design thinking. Subsequently, in the late 1970s Rob and I introduced private information into classical valuation equilibrium theory in the sense of the Debreu paper I mentioned above. The commodity point we introduced turned out to be key to endogenizing the length of the work week, which in turn is key in business cycle theory.

In 1978-79 I visited the University of Chicago as its Ford Foundation Research Professor. The following year I visited the Northwestern University economics department, where I took up running. This became my form of exercise for seven years until my knee gave way. That year at Northwestern I received an offer from the University of Minnesota. I accepted it, given that Minnesota had the best graduate program and was the leading producer of new assistant professors, with Thomas Sargent and Neil Wallace in macro. I think the success of the Minnesota program was due to its tradition of insisting that students first define terms, state their proposition, and then rigorously establish their proposition. With this approach, if you disagree with a conclusion, you have to disagree with one of the assumptions. The ample supply of ambitious, imaginative students was also crucial to the success of the program.

I began my association with the Federal Reserve Bank of Minneapolis in the fall of 1981, following in the footsteps of Tom Sargent and Neil Wallace. I had joined the Minnesota faculty in the fall of 1980, but was on leave at Northwestern’s finance department most of that year so that my wife could complete the core part of her doctoral program in industrial psychology at Illinois Institute of Technology. A few years after beginning my association with the Federal Reserve Bank of Minneapolis, Gary Stern became president of the Bank, and Art Rolnick, director of research. Gary, a good economist, wanted a small set of top economists around him with whom to consult on a variety of economic matters. Under Art’s leadership, this objective was achieved and the bank’s research department became, and still is, a major center in macroeconomics research.

Minnesota did not hire me in macroeconomics, but rather in the field of industrial organization. I think the industrial organization group was excellent, with Herb Mohring, Rob Porter, and me. Rob’s leaving was a great loss. Our efforts at replacing him were unsuccessful, but in going after Boyan Jovanovic and Ariel Pakes, we did go after the right people.

In Minnesota I became an applied game theorist – heavily involved in youth soccer. Here is how it happened. When I took my son Andy, then 8 years old, to the neighborhood park for the fall park board soccer program, I learned that Jan had signed me up as a coach. That evening I began my coaching career in a sport that I had never played. This was a challenge. Players from the local park board teams formed a traveling team that played in the late spring and summer. William A. George and I helped coach this team, and after a few years I took over the coaching. Bill was an exceptional manager, and I was not surprised when he later made Medtronic the leading medical equipment firm in the world. Here is another individual that made good things happen. I have limited coaching skills, but with the strong support of the parents over the years, the team attracted a talented set of players and we moved to the highest level of competition.

Soon these players became too good for me to coach, so I became the manager and hired a skilled coach to work with that team during the season. Given there was no one else available, I ran the entire Westside Football Club. While I was happy when a new generation came along to run the club, I was proud of the fact that the program did well under my stewardship. This was a challenge that I met.

The Minnesota economics department did as well in the 1980s as it had in the 1970s – in part due to the skills of the chair, Jim Simler. Here is another person that created an environment in which good things happened: consensus was reached quickly and there was hardly any politicking. This made the Minnesota department unique. The department had no required courses, a principle that served it well since its founding. The students who were betting their career made the decisions. If no one signed up for your graduate course, the course was dropped. Having this rule mitigates a time consistency problem.

I was fortunate to have worked with a large number of outstanding students at Minnesota. Minnesota grads have done more than any group to advance macroeconomics. They are special. I will mention Stephen Parente, who helped me coach soccer, because subsequently we had a long and fruitful collaboration culminating in our book Barriers to Riches (2000). The collaboration was inspired by Stephen’s highly imaginative and original dissertation on growth. At the time, everyone in the profession was concerned with what a country should do to foster growth. We took the opposite tack. Our position was that all market economies would be rich absent barriers to efficient production. To put it another way, to go fast, ease up on the brakes. In our studies we adopted the methodology that Finn and I developed for addressing business cycle questions.

Stephen is not only a great economist, but also a great cook. For a number of years Stephen’s famous clam bakes were held at our house. He would have the lobsters flown in from Boston, where his family was still in the seafood business.

In the midst of these good times, an ominous development loomed in the department. One group could not attract students and insisted on the imposition of a required course sequence. At that point, I considered leaving and was thinking about Chicago. The commute would have been only a total of five hours per week. It is a great department and in many ways I was more a Chicagoan than a Minnesotan, as I had more interaction with the Chicago faculty than I did with the Minnesota faculty. Bob Lucas, Nancy Stokey, and Rob Townsend – all on the faculty at Chicago – had been collaborators in the past. In addition, I valued the interaction with Gary Becker, Lars Hansen, Jim Heckman, and Sherwin Rosen. Chicago had a large and respected graduate program, and I thought I could help make it better. But, there was a problem: One of the students in the program was Edward Simpson Prescott, my oldest son. It would have been unfair to him if I were to join the Chicago faculty while he was there.

In the mid-1990s, a new dean of Minnesota’s College of Liberal Arts dramatically cut the size of the Minnesota economics department. The problems can be traced back to the politicization of the selection of the regents of the university. The regents had become representatives of special-interest groups instead of supporters of the mission of the university. In 1995 their plan to re-engineer the university included a proposal to eliminate tenure.

In 1998 I received offers from a number of departments, including Chicago, and the University of Minnesota chose not to match them. My oldest son was no longer a student at Chicago, and I accepted their offer. Except for the commute, I loved Chicago, which is in a class by itself when it comes to economics. I was depressed when I had to leave because of a family health problem. What particularly attracted me to Chicago was that it presented a challenge, and to repeat, I love challenges. In the single year I was there as a member of its economics faculty, I detected a rise in student morale. The students had gained a little confidence and become less intimidated by the profession. (Chicago can be an intimidating place, with all those gargoyles staring down at you.) After one year as a faculty member at Chicago, I was rehired and returned to troubled Minnesota.

Three good things happened after my return. At the Bank, I began a fruitful collaboration with Ellen McGrattan, in which we derived the implications of the neoclassical growth model that Finn and I used in the study of business cycles for the value of the stock market. The theory worked for predicting the value of the stock market as it had worked for predicting the magnitude and nature of business cycle fluctuations. When Ellen’s (senior author) and my paper was accepted by the Review of Economic Studies in late November of 2004, I was a happy man. Needless to say, I was not the only happy person. Now, theory can be used to say whether the market is over- or under-valued, and by how much. The integration of the stock market into macro models has important ramifications for understanding the boom in employment and output in the United States during the late 1990s. These certainly are exciting times in macroeconomics, with so much progress being made using the methodology that Finn and I had developed.

The second good thing was the teaching of an undergraduate macro course in modern macro. It turned out to influence my subsequent research. In that course I used the neoclassical growth model, which Finn and I used to study business cycles. I also used the same model, but with land as a crucial input to production, to account for the 5,000 years prior to 1800 when there was little or no growth in living standards. One of the students in the class repeatedly asked the question, why use one production function for one period and another one for the other? He was a wise guy, but I liked him. His question was a good one, and was one that the profession should have been asking itself. Gary Hansen and I came up with the answer in our “Malthus to Solow” paper. We permitted both production functions to be used at all times. This unified the models of the two periods and accounted for the long transition commonly referred to as the Industrial Revolution. Economics owes a debt to that student.

The primary reason I taught this course was that I saw the need to develop material that could be used to teach modern macro. Typically, the material taught in undergraduate macro courses teaches the Keynesian macroeconomics models, which failed, and failed spectacularly, in the 1970s. I wish that I had just a little of the Samuelson genius and could write a great textbook for the teaching of modern macroeconomics. It is needed.

In that course, I wanted the students to use the theory to evaluate policy. Therefore, I made up an exercise in which they had to evaluate whether a consumption tax or an income tax is a better way to finance a transfer payment. The model economy that they used is basically the one that Finn and I use in our study of business cycles, but without technology shocks. The students came to me and said there had to be something wrong – they could not find any income tax rate that finances the transfer. I was sure they were wrong and did the exercise myself. They were right, there was none. This is when I realized the quantitative importance of the tax system for output and employment. This was the topic of my American Economic Association’s 2002 Richard Ely Lecture and subsequent work establishing that tax rates account for most of the huge differences in labor supply across the major advanced industrial countries and for the large change in European labor supply over time.

The third good thing that happened upon my return was that my Bank colleagues, Hal Cole and Lee Ohanian, broke a taboo and used the neoclassical growth model to examine the Great Depression. What they found was eye opening. This motivated Tim Kehoe and me to organize a conference where a number of scholars used the neoclassical growth model to analyze a number of depressions. In this project, I was fortunate to make a match with Fumio Hayashi. We studied the lost decade of Japanese growth that began in 1992. Treating total factor productivity (TFP) as exogenous, the theory accounts well for this episode. This TFP factor, which is so important in accounting for business cycle fluctuations, is also important for understanding periods of depression and prosperity. This is further support for Parente’s and my position that the central issue in macroeconomics is to understand the mapping from policy arrangements to TFP levels.

In early 2003, my wife notified her company that she was retiring in January 2004. This made it possible for me to resign from Minnesota when the Minnesota administration refused to honor a written provision in my rehire agreement. This provision promised much-needed graduate student financial aid.

Once I was committed to leaving the University of Minnesota, the only question was where to go. We considered three places. My wife picked Arizona State University in Tempe, Arizona. One thing I particularly like about ASU is that its economics department is on track to becoming a great one. The people have good judgment. The department enjoys the strong support of administration, which is getting the needed resources. I welcome the challenge of helping to make the ASU economics department a great one.

1. “Valuation Equilibrium and Pareto Optimum,” Proceedings of the National Academy of Sciences of the U.S.A., 40, 588-92, 1954.

This autobiography/biography was written at the time of the award and later published in the book series Les Prix Nobel/ Nobel Lectures/The Nobel Prizes. The information is sometimes updated with an addendum submitted by the Laureate.

Edward C. Prescott died on 6 November 2022.

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 12 laureates' work and discoveries range from proteins' structures and machine learning to fighting for a world free of nuclear weapons.

See them all presented here.