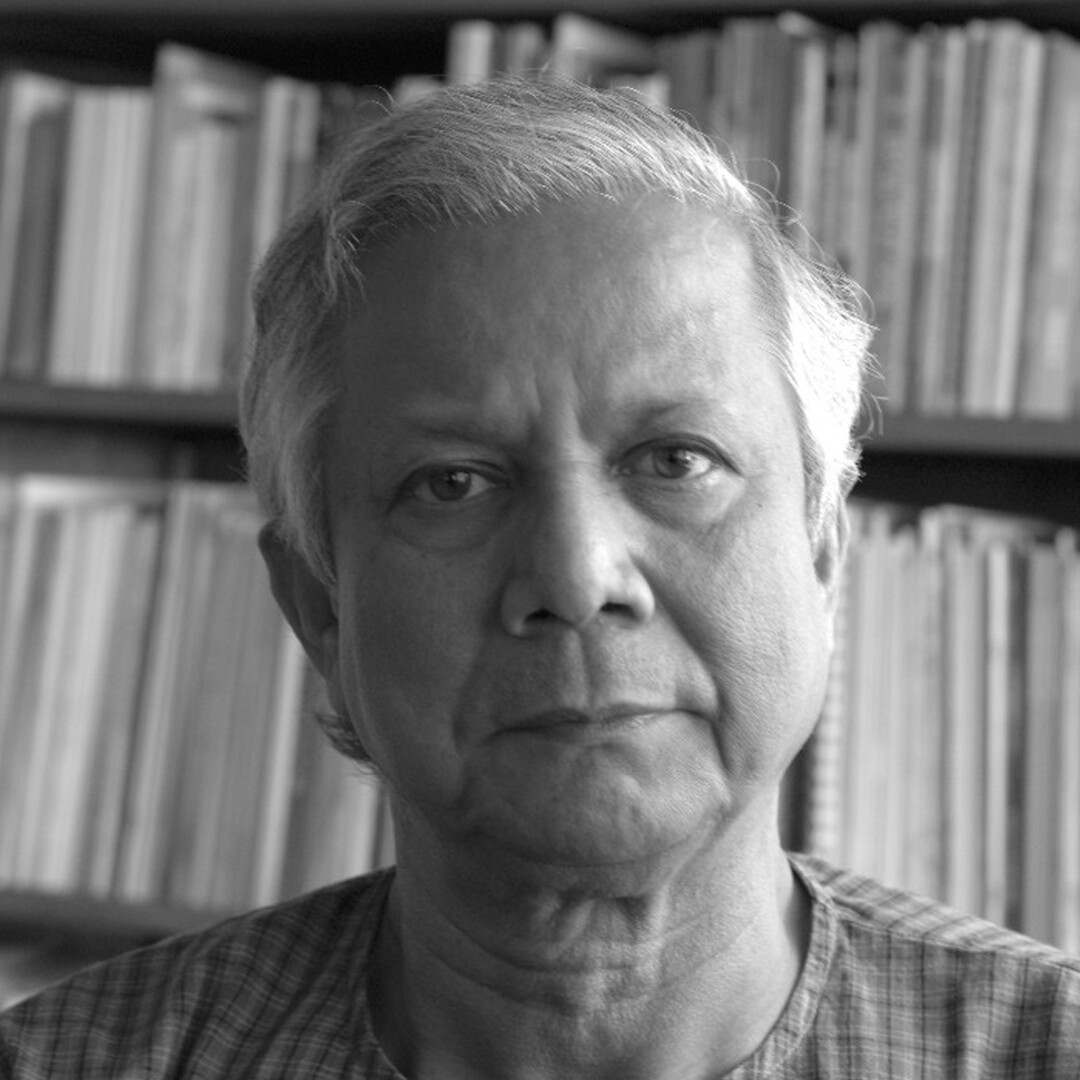

Muhammad Yunus

Speed read

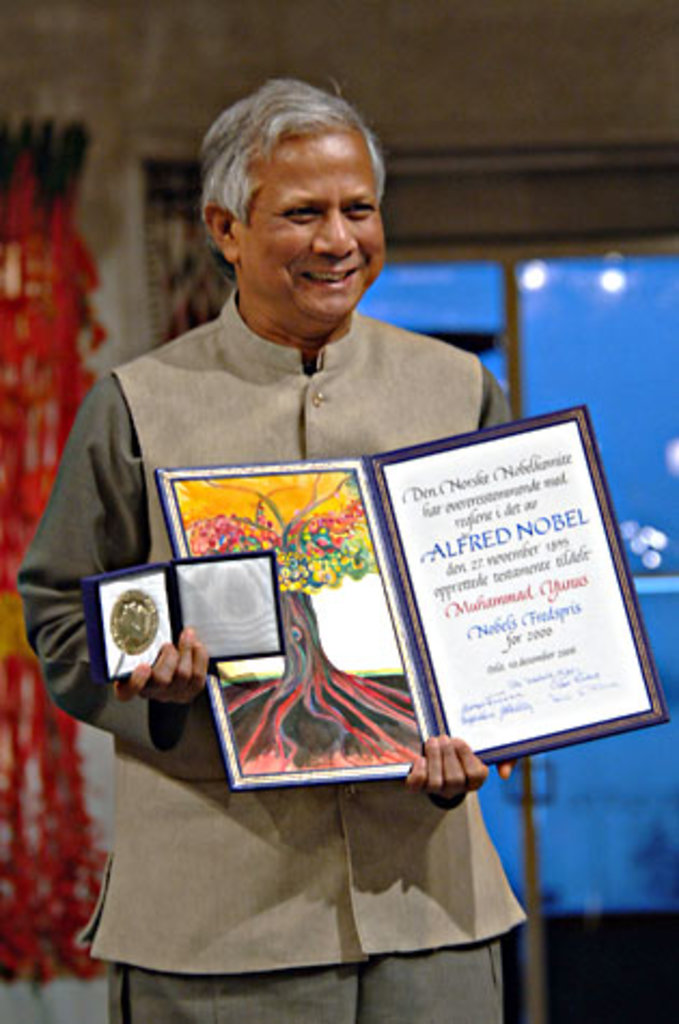

Muhammad Yunus was awarded the Nobel Peace Prize, jointly with Grameen Bank, for his efforts through microcredit to create economic and social development from below.

Full name: Muhammad Yunus

Born: 28 June 1940, Chittagong, British India (now Bangladesh)

Date awarded: 13 October 2006

Banker to the poor

Professor Muhammad Yunus is from Bangladesh. During a 1974 study of a poor village, he realised that something was wrong with the economic theories he was teaching. Access to credit was a human right, he felt, and his mission became to end poverty. Despite warnings from banks and the government, Yunus started giving small loans to the poor. In 1983, he founded Grameen Bank to drive economic and social development from the bottom up. Yunus believed women spend the money they borrow in ways that benefit their families and local communities, and that they are more responsible than men. So more than 96 per cent of the loan-holders were women. The Nobel Committee described Yunus as a leader who had succeeded in translating his vision into practical actions – to the benefit of millions.

"Poverty is created by the system we created … If we can fix the system, we can cure poverty."

Muhammad Yunus, 4 February 2005

© The Norwegian Nobel Institute 2006. Photo: Ken Opprann

"I said, and I still say, the banking systems are designed to benefit the privileged. It is by design the poor are left out."

Muhammad Yunus, 4 February 2005

The poverty trap

Imagine that you are a woman from a village in Bangladesh. You scrape a living making bamboo stools. Because you do not own anything you can put up as security, you cannot get a loan from a bank. To pay for the bamboo you need to make the stools, you must borrow from a money-lender, who demands a high rate of interest. To pay back the loan you must sell your stools for a high price. But if it is too high you risk not being able to sell them, and even if you do, the money-lender takes most of the profit. This true story gave Yunus the idea for microcredit.

From idea to bank

Yunus’s idea was to give poor people small loans and advice on how to use the money. The aim was to give people the help they need to get started. Yunus began by lending money from his own pocket to see if the idea would work in practice. In 1983 he opened Grameen Bank. Yunus’s goal is that, in the future, poverty will be something you will only see in a museum.

The link between poverty and peace

Not everyone saw the link between peace and the work of Muhammad Yunus and Grameen Bank. Since the 1950’s the Norwegian Nobel Committee have looked upon the concept of working for peace in a wider context. And by giving the Nobel Peace Prize to Yunus and Grameen Bank, they once again considered the fight against poverty as a contribution towards peace. As Yunus himself has said: “Poverty is a denial of human rights. If we raise people out of poverty we can build peace both within society and between societies.”

Opposition to the peace prize laureate

Muhammad Yunus gained many opponents after he revealed plans to found a new party to fight corruption in Bangladesh in 2007. The peace laureate shelved his plans, but was again criticised in late 2010. A TV-film accused him of exploiting his position in Grameen Bank to misuse Norwegian aid funds, of charging unfairly high interest and for unfair penalties upon borrowers who defaulted on loans. Even though Yunus was exonerated from the accusations, he was dismissed from his post as managing director at Grameen Bank in 2011.

Learn more

"Banker to the Poor”. Professor Muhammad Yunus established the Grameen Bank in Bangladesh in 1983, fueled by the belief that credit is a fundamental human right ...

Disclaimer: Every effort has been made by the publisher to credit organisations and individuals with regard to the supply of photographs. Please notify the publishers regarding corrections.

Nobel Prizes and laureates

Six prizes were awarded for achievements that have conferred the greatest benefit to humankind. The 14 laureates' work and discoveries range from quantum tunnelling to promoting democratic rights.

See them all presented here.